Top U.S. Cities Installing the Most Non-Tesla EV Chargers

The EV revolution continues to grow in the United States despite slow sales growth in the first quarter (Q1). According to Kelley Blue Book, EV sales growth slowed to 2.6% in Q1 2024. In Q1 2023, EV sales outpaced Q1 EV sales in 2022 by an impressive 46.4%.

Because Tesla continues to lead the US EV market, its Q1 sales growth losses of 13.3% dragged down the average. Others, including GM, VW, and Nissan, reported slow or negative sales growth.

In Q1, sales were booming for many others. Ford was notable at 86.1% sales growth, and GM’s Cadillac, Hyundai, Rivian, Mercedes, BMW, and Toyota all did well.

EV Charging is Important for EV Adoption

Automotive experts have described a lack of public charging as one of the major barriers holding back EV adoption. It’s likely one of the most significant barriers that caused the slowdown in sales growth in Q1.

The map on the US Department of Energy’s Alternative Fuels Data Center (AFDC) website shows which areas lack public EV charging stations. EV adopters in these areas are experiencing the most significant challenges due to a lack of charging availability. However, things are improving.

Public charging is growing fast, thanks to significant private investment bolstered by billions in federal funding. The ambitious $5 billion NEVI Formula Program was outlined in the $1.2 trillion Infrastructure Investment and Jobs Act. NEVI funding establishes EV charging “corridors” along major freeways, connecting the states.

Public charging wasn’t profitable in the early days of the EV revolution. However, that is changing, thanks to increased utilization.

“There’s a common belief in the industry that fast charging isn’t profitable,” said Rohan Puri, CEO of Stable Auto. “However, our data shows that this is no longer the case for a lot of stations. Utilization is up across many states in the US, growing from an average of 11.4% in April 2023 to 18.1% in March 2024.”

Non-Tesla EV Charging Companies, Networks, and Stakeholders

Some current major players in the EV charging industry include ChargePoint, EVgo, EVConnect, Blink Charging, and Electrify America. Electrify America is a subsidiary of Volkswagen Group of America.

Electric truck maker Rivian operates its own charging network, the Rivian Adventure Network, while Ford offers the Ford BlueOval Charging network.

In February, automakers BMW, General Motors, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis officially partnered to offer EV charging. The partners launched a charging network named Ionna, with plans to build at least 30,000 chargers in the US.

7Charge is a network of publicly available EV fast chargers owned and operated by 7-Eleven at its stores. Circle K is another store offering its own EV charging.

Installation of EV charging requires cooperation and collaboration between numerous key players, including charge point operators (CPOs), charge point owners, and e-mobility service providers (EMSPs).

Tesla SuperCharger EV Charging and Others

Tesla offered its own EV charging to customers, the Tesla SuperCharging network. Tesla vehicles and chargers use Tesla’s North American Charging Standard (NACS), while non-Tesla vehicles use the Combined Charging System (CCS). In 2023, Tesla opened part of its SuperCharger network to non-Tesla vehicles.

NACS Becoming the EV Charging Standard

Nearly all major carmakers and charging companies have announced they are switching from CCS to NACS. The Society of Automotive Engineers (SAE) is currently standardizing NACS as the SAE J3400 standard.

Upon hearing the news about the Tesla Supercharger layoffs, General Motors, Ford, and others said that the layoffs would not affect their plans to implement NACS charging in the new versions of their vehicles.

CCS has been used for new non-Tesla vehicles until now. Due to the two competing standards, compatibility was a major problem when charging. Adapters are available for legacy CCS-equipped cars to charge on NACS chargers.

Tesla Laid off its SuperCharger Team and Cut Back on Charging

In April, news broke that Tesla was laying off its team working on the Supercharger network, shocking the EV industry. Until then, Tesla’s SuperCharger network had been well-respected as providing extensive EV charging services across the US, with a high reliability rate.

Subsequent news broke that other companies were moving in to capture opportunities from Tesla’s charging cutbacks. British Petroleum, a major oil company, announced its EV charging division, BP Pulse, was actively expanding into areas that Tesla was formerly working in for public EV charging stations.

After seeing declining profits in the internal combustion engine fueling industry, British Petroleum is one of the leading big oil companies making significant investments in EV charging. Shell is another big oil company known for its considerable early investment in EV charging through its Shell Recharge division.

Stable Auto Reports on the Number of EV Charging Ports Deployed

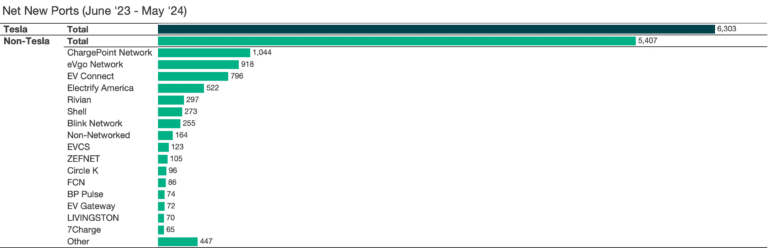

Stable Auto ran an analysis showing that Tesla still leads the number of ports deployed despite its cutbacks.

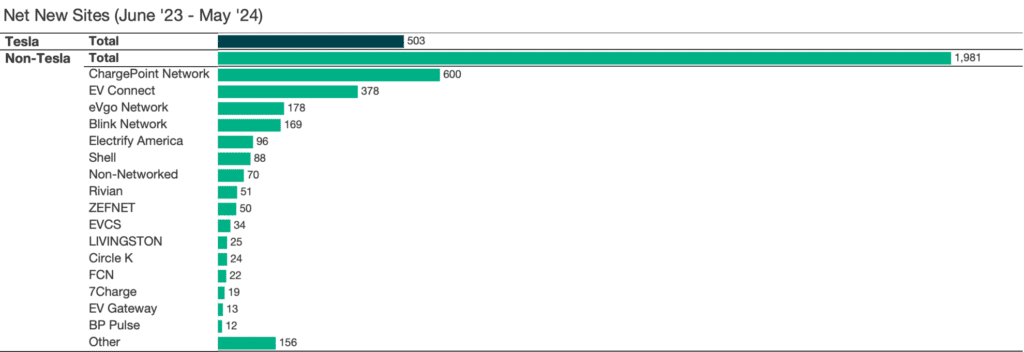

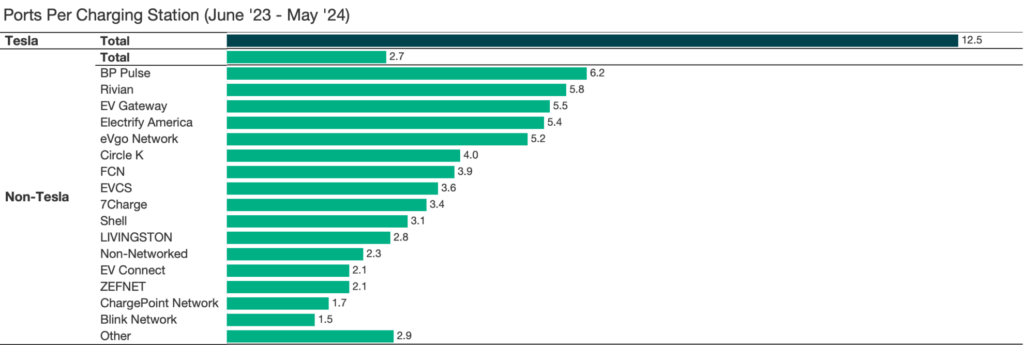

Dan Marchini, Director of Customer Success at Stable Auto, said, “When it comes to the number of ports deployed in the past year, non-tesla CPOs have a lot of catching up to do, even with the recent Tesla announcements. Despite deploying over 1400 fewer locations this year, Tesla has installed almost 900 more ports, averaging ~13 ports per install versus ~3 for everyone else. If the goal is a land grab, non-tesla CPOs are turning up the heat, but if it’s to cost-effectively deploy right-sized stations for customers, I’d say there’s still a ton of catching up to do.”

Marchini analyzed data from the US Department of Energy’s Alternative Fuels Data Center (AFDC). The data reflects EV charger deployments from June 1, 2023, through May 31, 2024. The analysis found 6,303 Tesla ports were deployed, while 5,407 non-Tesla ports were deployed.

Stable Auto’s analysis of net new sites deployed June 1, 2023, through May 31, 2024, showed ChargePoint leading at 600, with EV Connect following at 378, then EVgo at 178. Non-Tesla sites totaled 1,981, and Tesla sites totaled 503.

Stable Auto’s analysis of ports per charging station from June 1, 2023, through May 31, 2024, showed BP Pulse in the lead for non-Tesla ports with 6.2, followed by Rivian at 5.8 and EV Gateway at 5.5. Tesla’s ports per charging station were significantly higher than the rest, at 12.5.

Stable Auto, based in San Francisco, California, offers software that EV charging companies can leverage to make sound decisions in placing and pricing their EV charging infrastructure. The company’s software is built on over four years of utilization data from tens of thousands of EV chargers.

EVAdoption Reports on Top Ten Cities Offering EV Charging

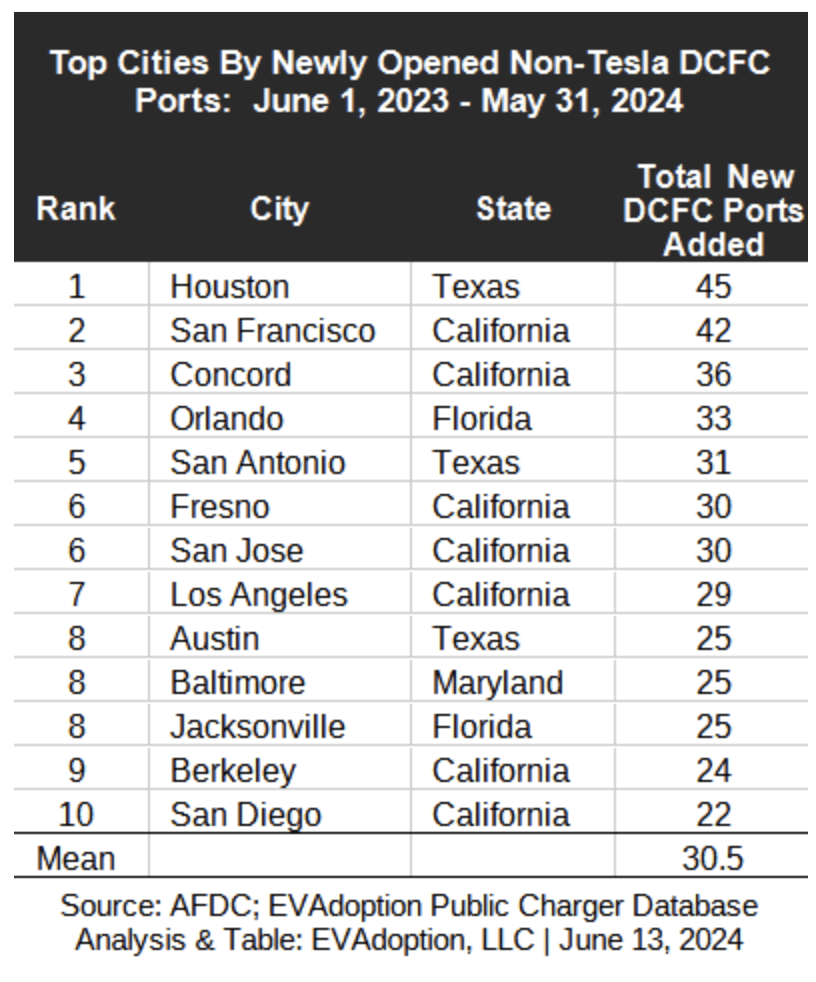

EV expert Loren McDonald provided an analysis for data on the top ten cities adding the most non-Tesla chargers in the US. McDonald is the CEO of EVAdoption, an EV/EV charging data and analysis firm.

“No surprise that 7 of the top 13 cities for new DC fast charging ports were located in California — charging networks are focused on where EV sales volume is strong and the potential for utilization is highest,” said McDonald.

“Houston made the top slot due to a 24-port BP Pulse charging hub opening in April 2024. For Level 2 ports, California cities grabbed three of the top four slots, but the mix was much more diverse with seven cities located in six states, again, either highly populated states or high EV-adopting states and markets,” added McDonald.

The tables below show which cities added the most charging stations. The data shows only LDV (light-duty vehicle) charging stations. Heavy-duty stations and stations not open to the public were excluded.

Top Thirteen Cities Adding DCFC EV Charging Stations, Ranked by EVAdoption.com

The top thirteen US cities adding the most DCFC EV Charging stations for June 1, 2023, through May 31, 2024, are ranked below. Two cities tied for the 6th rank at 30 new DCFC ports each. Three cities tied for the 8th rank at 25 new DCFC ports each. California showed up the most, more than any other state. This is because California currently leads the US in EV market share and offers many EV and EV charging incentives. According to data from Experian, BloombergNEF, and the California New Car Dealers Association, California had the highest number of EVs sold in 2023, at 25%, as reported by Edmunds.

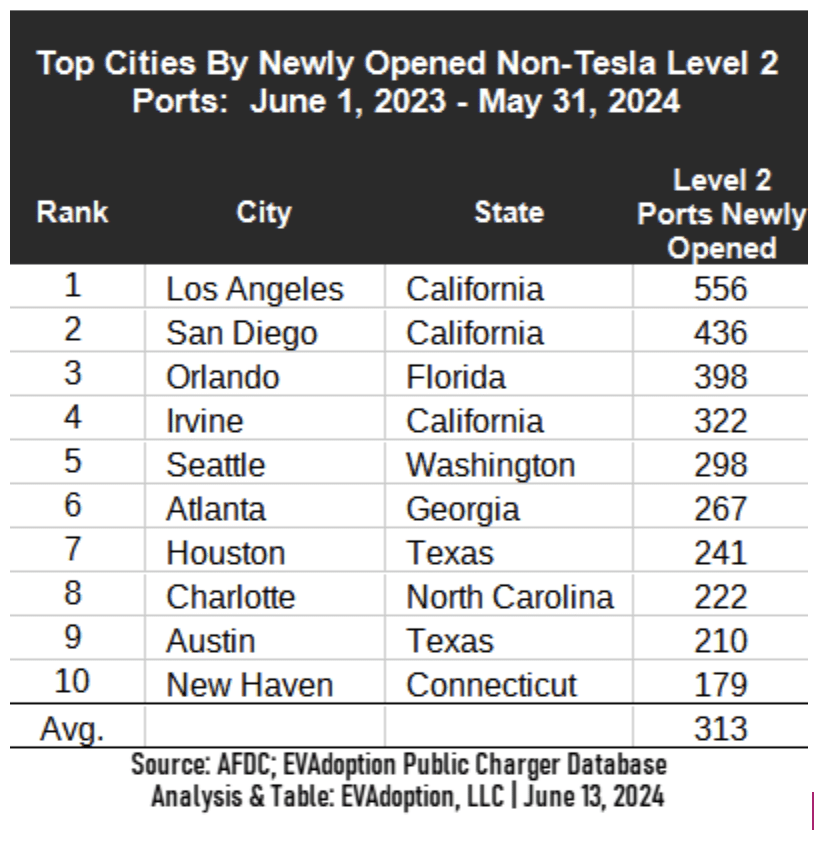

Top Ten Cities Adding Level 2 EV Charging Stations Ranked by EVAdoption.com

Loren McDonald, CEO of EVAdoption, is a well-respected electric vehicle (EV) expert. EVAdoption offers research and analysis on EV and EV charging trends. According to EVAdoption data, below are the top ten US cities adding the most Level 2 EV Charging stations from June 1, 2023, through May 31, 2024. Three cities in California made the top four since California is the leading US state for EV adoption.

Why Supporting More Charging is So Crucial to the EV Revolution

As more EV charging stations are installed, EV adoption will become easier. However, we must remain diligent in supporting private and government efforts to install more charging stations to ensure EV adoption continues to move forward at a rapid pace. The environmental benefits of EV adoption are well documented in the fight against climate change.

About the Author: Bill Pierce, Publisher, EVinfo.net

EVinfo.net is a thought-leading EV industry publication that delivers information and news about electric vehicles (EVs). We strongly recommend that you attend the EVCS & Expo, North America’s leading EV charging event.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services