Will Canoo Survive 2025’s EV Industry Struggles?

With the incoming administration, there’s a lot of speculation about what will happen to the US electric vehicle (EV) industry in 2025. Most analysts agree legacy automakers — specifically the “Detroit” companies General Motors, Ford Motor and Chrysler parent Stellantis would be the biggest winners. Obviously, Tesla stands to benefit as it has already seen a huge jump in stocks as election results were announced.

The picture is less rosy for EV startups such as Rivian Automotive, Lucid Group, Canoo, and others. The new administration could defund or limit federal EV subsidies and incentives. Auto industry insiders said it would be difficult for the new administration to completely gut the IRA, as billions of dollars has been spent to build EV and clean energy factories in Ohio, Georgia, the Carolinas, Nevada and Oklahoma.

A big problem with government cutting funding for EVs is that American carmakers will fall further behind China in global EV sales. Doing that will be a disaster for America’s economy. One thing is for certain, the EV revolution is far to widespread and integrated into the automotive industry now to be fully stopped. It can only be slowed.

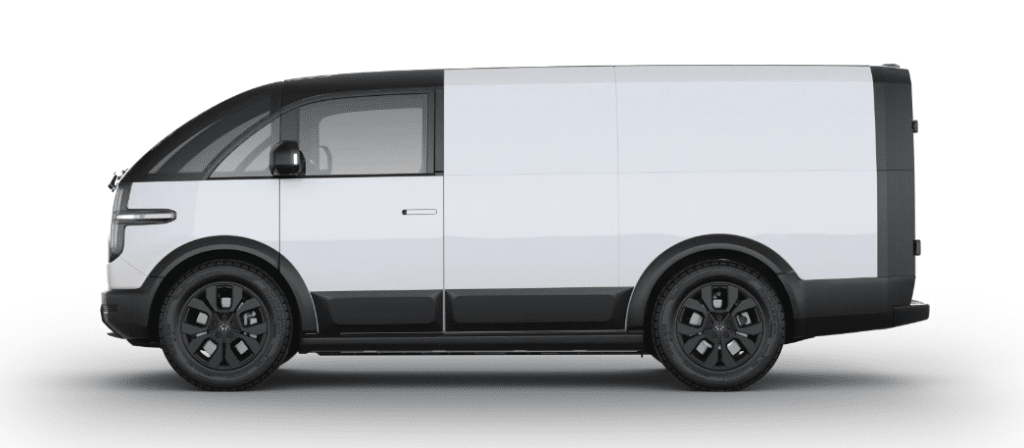

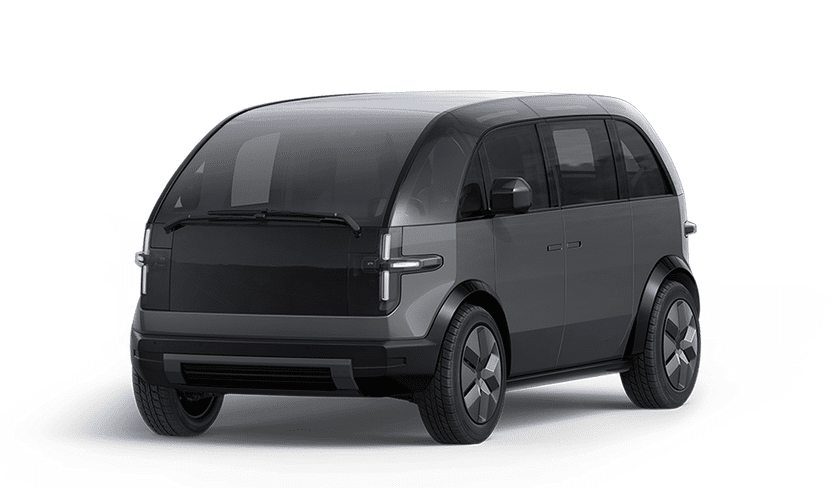

Canoo’s Troubles

It’s unclear at the moment how much government cutbacks will hurt Canoo. Canoo’s latest 8-K filing with the SEC paints a challenging picture for the EV startup. As of October 30, Canoo reported that its cash and cash equivalents had dwindled to just $4.51 million, which is precariously low for a company still in a high-burn, low-revenue growth phase. The company’s financials for the first half of 2024 show a staggering net loss of $117.6 million, underscoring the depth of its financial struggles.

Despite its early promise and some high-profile projects—like electric vehicles for NASA’s Artemis program—Canoo has faced persistent difficulties, including limited deliveries and minimal revenue generation. For the full previous year, the company generated only $886,000 in revenue from delivering a mere 22 vehicles.

To keep the company afloat, Canoo has had to turn to unconventional financing sources, including loans from a fund associated with its CEO, Tony Aquila. In its October 30 filing, Canoo disclosed a $2.7 million loan from this fund, following a previous $1.2 million loan disclosed on October 18 with an 11% interest rate.

This reliance on personal loans from its CEO highlights the severity of Canoo’s liquidity crisis. With limited cash reserves, continued heavy losses, and minimal revenue, the company’s future hinges on securing additional funding, cutting costs, or significantly ramping up production and sales to sustain operations.

Canoo’s financial struggles have led the company to adopt drastic measures to conserve cash, affecting both its workforce and operational plans. According to The Oklahoman, Canoo will furlough 30 employees at its Oklahoma City assembly site, leaving these workers without pay for 12 weeks. Their healthcare benefits are set to expire at the end of November, intensifying the impact of the furlough.

With limited funds and significant operational costs, Canoo faces mounting pressure to secure sustainable financing or partnerships to remain viable in an increasingly competitive EV industry.

“Canoo has made the difficult decision to temporarily reduce our workforce in Oklahoma City by furloughing 23% of our factory workers for a period of twelve weeks as part of a broader realignment of our North American operations,” Canoo said in a statement.

The statement continued: “This reduction is a continuation of our efforts to consolidate our U.S. workforce which includes redistributing some of our tenured and skilled employees to our Oklahoma City and Texas facilities as part of our comprehensive plan and supply chain harmonization to prepare the company for the next phase of growth.”

Canoo’s Executive Exodus

Canoo’s financial troubles have triggered a series of cost-cutting and organizational shake-ups as the company attempts to stabilize. Amid its dwindling cash reserves, Canoo recently relocated its headquarters from Los Angeles to Texas, part of a broader restructuring effort. However, the move also coincides with the departure of several key executives, adding further disruption to its leadership team. Sohel Merchant, Canoo’s chief technology officer, exited in August, followed by Christoph Kuttner, senior director of advanced vehicle engineering, in September. On October 31, the company lost both its CFO, Greg Ethridge, and general counsel, Hector Ruiz. Though Canoo has refilled these critical positions, the new executives face substantial challenges, from rebuilding investor confidence to handling complex legal and financial issues.

Canoo is also facing legal pressure, with multiple lawsuits filed by suppliers, including a notable case in August where Air Capital Equipment alleged that Canoo owes over $570,000 for a compressed air system purchased on credit. This financial strain is compounded by disclosures of substantial, arguably questionable, spending practices, including more than $1.7 million spent on private jet expenses in a year when the company earned only $886,000 in revenue.

With furloughs impacting its Oklahoma assembly site and executive turnover adding uncertainty, Canoo’s new leadership is tasked with navigating the company through severe financial and operational challenges, including strained supplier relationships, ongoing lawsuits, and a need to conserve cash as it fights to survive in a fiercely competitive EV market.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services