Why America’s Auto Industry Needs Government Help

China has risen to dominate global car production, now exporting more vehicles than any other country, supported by the world’s largest domestic car market and heavy government investment in automation. Despite recent economic slowdowns leading to overcapacity, China’s automaking power remains strong. While countries like the U.S. impose tariffs on Chinese EVs, such measures are unlikely to dent its dominance in the industry. China’s current production capability is nearly double its domestic demand, showcasing both its industrial strength and the challenges of balancing output and consumption.

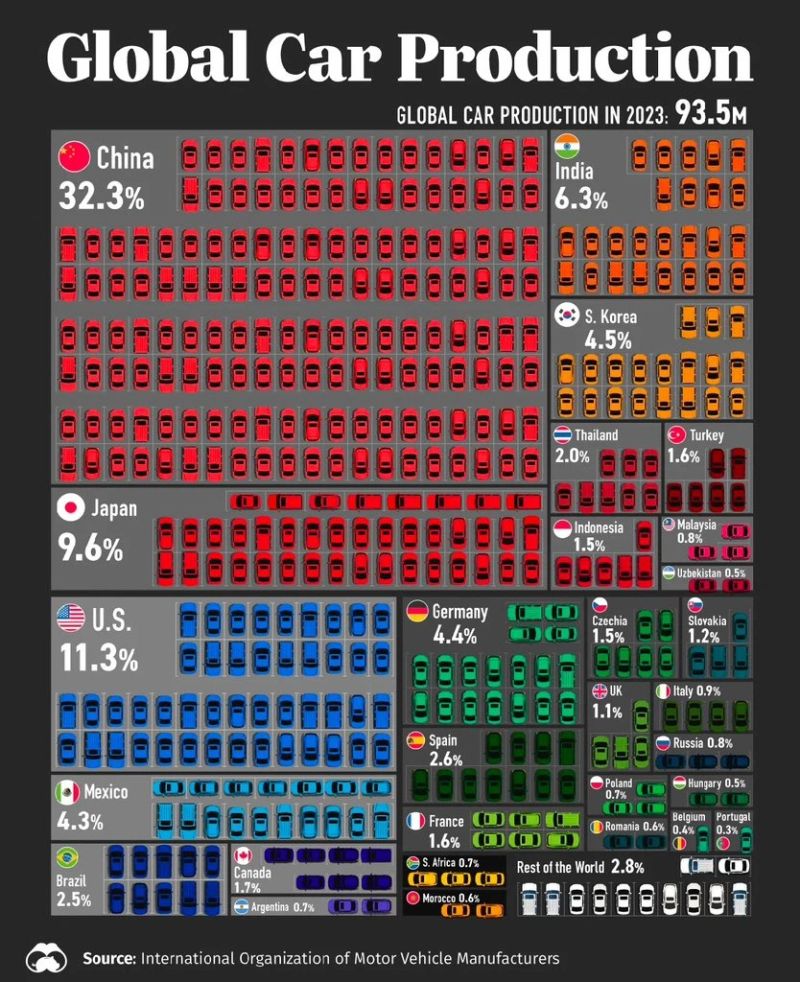

China produced 32.3% of the world’s cars in 2023, according to the International Organization of Motor Vehicle Manufacturers. In the infographic below, one can easily see how America is struggling to compete, at 11.3%.

China is leveraging its overcapacity in vehicle production to expand exports, becoming a global leader in electric vehicle (EV) exports, with brands like BYD offering competitive pricing. However, this expansion faces backlash from the U.S. and EU, which have imposed tariffs over concerns about job losses and national security. While Chinese automakers dominate domestically, strict tariffs on imports ensure most cars sold in China are locally made. Declining demand for gas-powered vehicles in China has also led to increased exports of these models.

China exported 1.7 million electric cars last year, nearly 50% more than Germany, the second-largest exporter. Europe is the primary destination, favoring China’s compact models, while Southeast Asia is another growing market due to affordability. Plug-in hybrid exports are also increasing, catering to regions with limited charging infrastructure, making them ideal for short trips. Since 2020, China’s EV shipments have surged, solidifying its global leadership in electric mobility.

China Invested Heavily in EVs for Over Fifteen Years

China’s substantial and long-term investment in electric vehicles (EVs) positioned it as a global leader in the EV market. Starting in the early 2000s, the country saw electric vehicles as a critical path to reduce its reliance on imported oil and strengthen its energy security. Premier Wen Jiabao’s commitment to EVs in the 2000s, along with the appointment of Wan Gang—an experienced engineer with international credentials—set the stage for a policy-driven push toward EV dominance. This effort was reinforced by substantial financial support from the government in the form of subsidies, loans, and tax incentives, creating an environment conducive to the rapid development of both electric cars and the necessary battery technology.

The scale of China’s investment is staggering, with over $230 billion channeled into the EV and battery sectors since 2009. This has resulted in not only a thriving domestic market but also the emergence of Chinese EV manufacturers like BYD, NIO, and Xpeng, which have gained significant market share. As a result, approximately half of China’s car buyers now opt for battery electric or plug-in hybrid cars, highlighting the country’s growing embrace of electric mobility.

China’s dominance is further bolstered by its expansive manufacturing capacity, with dozens of EV production facilities powered by state-supported infrastructure, including low-interest loans, tax incentives, and cheap land. These efforts have also been instrumental in helping China become a key global supplier of EV batteries, a critical component of the electric vehicle ecosystem. The combination of aggressive domestic policies and international expansion has made China a formidable force in the global EV market.

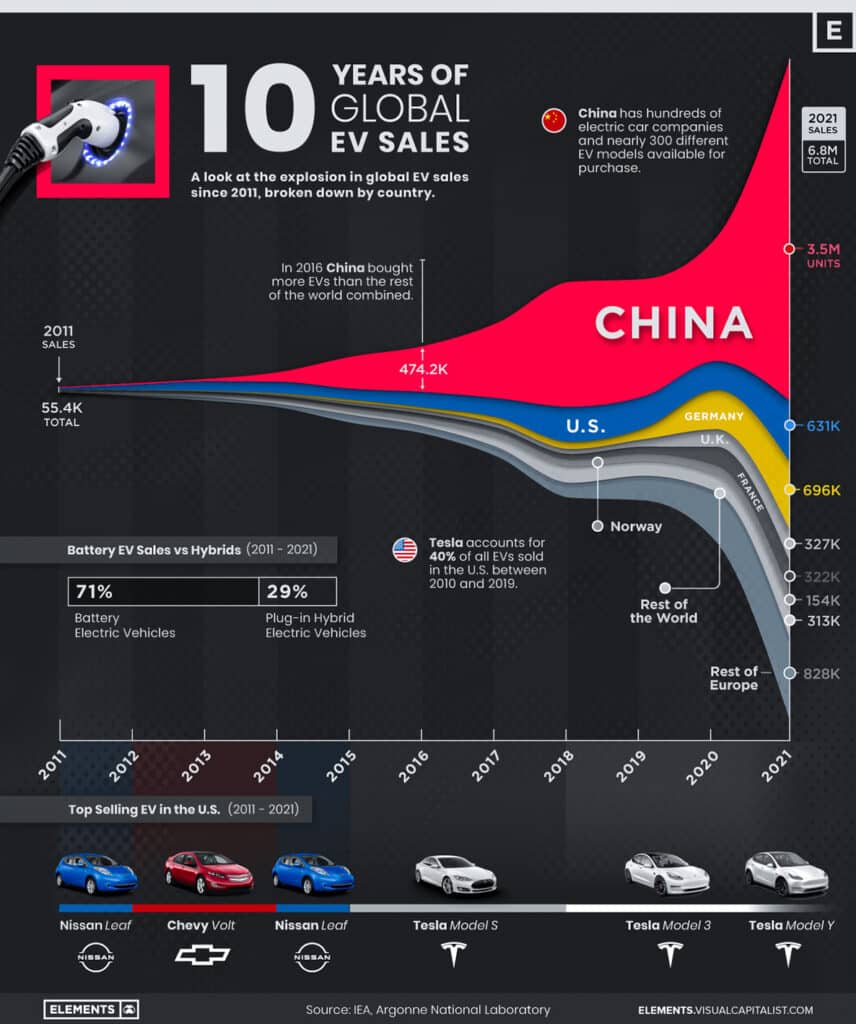

This infographic by Visual Capitalist shows just how severe the differences in EV sales are in the global automotive industry, and how far ahead China is right now, with an over 50% adoption rate at the end of 2024.

Looking ahead, China is expected to continue its heavy investments in the EV sector, both to maintain its leadership position and to achieve further technological advancements. The ongoing subsidies, supportive policies, and extensive infrastructure investments signal that the country will remain a key player in shaping the global transition to electric vehicles.

The shift toward electric vehicles (EVs) in China has significantly impacted the domestic market for traditional gasoline-powered cars. As demand for internal combustion engine (ICE) vehicles has waned domestically due to the growing popularity of EVs, automakers are left with excess production capacity and a large stock of unsold gasoline cars. With more than 100 factories capable of producing around 40 million ICE vehicles annually—far more than the domestic market can absorb—automakers are now turning to international markets to offload these cars, often at steep discounts.

Russia has emerged as the largest importer of these discounted gasoline cars, especially after the invasion of Ukraine. The withdrawal of Western automakers from the Russian market opened up a significant opportunity for Chinese car manufacturers to fill the void, capitalizing on the demand for low-cost alternatives. In addition to Russia, countries in Latin America and the Middle East, especially those with lower-income populations, have become key markets for China’s surplus gasoline cars. These regions have been drawn to the affordability of Chinese-made vehicles, which are often priced much lower than those from Western or Japanese manufacturers.

However, while these overseas sales offer a temporary solution to the overproduction problem, the broader trend in the automotive industry is clear: the future is electric. As a result, many of China’s traditional car manufacturers are struggling with the transition, with some being forced to shutter or mothball assembly plants that produce gasoline cars. This is a sign of the significant structural shift taking place within the Chinese automotive industry, as it pivots from an ICE-dominated market to a future dominated by electric vehicles.

Despite the current challenges, Chinese automakers are likely to continue pursuing global markets for their gasoline cars in the short term, but they will increasingly focus on scaling up EV production and innovation to stay competitive in the long run.

Tariffs Won’t Slow China Down

The flood of Chinese-made cars into global markets has indeed sparked concerns in many countries, leading to increased tariffs and other trade measures aimed at protecting local industries. Governments in regions like the U.S., European Union, India, and Brazil have imposed tariffs to counter the competitive advantage that Chinese automakers have gained, especially in the electric vehicle (EV) sector. These tariffs, which vary by country, are designed to offset the impact of the heavy subsidies that Chinese automakers have received from the government and state-controlled banks.

For example, the U.S. has implemented a flat tax on Chinese cars, while the European Union has devised a more complex system, calculating tariffs based on the estimated amount of subsidies received by each automaker. India and Brazil have also taken steps to protect their local car industries, viewing the influx of cheap Chinese cars as a threat to their own markets.

Despite these tariffs, Chinese carmakers still maintain a strong competitive edge, especially in the electric vehicle segment. Analysts at UBS estimate that Chinese-made cars, like those from BYD, cost about 30% less to assemble compared to similar vehicles from Western manufacturers. This price advantage is primarily driven by China’s dominance in the EV battery supply chain. China controls nearly the entire global supply chain for electric vehicle batteries, from mining and refining raw materials to manufacturing and assembling the final products. This vertical integration allows Chinese automakers to keep costs low, particularly on one of the most expensive components of electric cars: the battery.

As a result, while tariffs may slow the expansion of Chinese carmakers in some markets, they are unlikely to fully negate the cost advantage that comes from China’s control over the EV supply chain. This advantage, coupled with the aggressive pricing strategies of Chinese companies, means that they are likely to continue gaining ground in global automotive markets, especially as demand for electric vehicles grows.

“China’s support for its EV industry extends beyond short-term per-car subsidies, representing a decades-long strategic plan to dominate the global market. This sustained support has offered an profound advantage for Chinese automakers against private Western car companies. It’s not a fair “free market” competition when national resources are pitted against private companies. Therefore, protective tariffs on Chinese EVs may be necessary to allow Western automakers time to adapt and catch up, despite the drawbacks of tariffs. Ultimately, this situation raises a critical question about which economic system we want to endorse: a state-controlled model or our more “free market” approach, said Derek Kerton, Chairman, Cleantech Council.

Production Costs Much Lower in China

A UBS comparison between the Volkswagen ID.3 and the BYD Seal, reported by the New York Times highlights the significant cost advantages that Chinese automakers, like BYD, have in various aspects of vehicle production. Here’s a breakdown of the cost differences:

- Battery: The cost of batteries for the BYD Seal is 29% cheaper than for the Volkswagen ID.3. This is crucial since the battery is one of the most expensive components of an electric vehicle. China’s dominance in the EV battery supply chain, from raw materials to manufacturing, allows Chinese companies to reduce battery costs significantly.

- Body, Chassis, and Wheels: The BYD Seal’s body, chassis, and wheels are 38% cheaper to produce. This can be attributed to China’s advanced manufacturing techniques, economies of scale, and lower material costs.

- Electronics: Electronics, which play an increasingly important role in modern vehicles, cost 17% less in the BYD Seal compared to the ID.3. Chinese companies have developed expertise in producing affordable, high-quality electronics, including essential components for EVs like control systems and infotainment.

- Other Components: Overall, other components are 23% cheaper in the BYD Seal. This includes things like smaller mechanical parts and systems that aren’t as critical as the battery but still contribute to overall cost savings.

- Interior: The cost of the interior of the BYD Seal is 17% lower. Lower labor and material costs in China help drive these savings, allowing for similar quality interiors at a lower price.

- Distribution and Other Services: Distribution and other services related to the car’s sale are 63% cheaper in China. This reflects China’s highly efficient logistics and distribution networks, which are often more cost-effective than in many Western countries.

- Factory: The cost of setting up and maintaining factories in China is 62% lower. China has a robust infrastructure, lower overheads, and favorable government policies, all of which contribute to significantly reduced manufacturing costs.

- Labor: Labor costs are 77% lower in China. With a large, highly skilled workforce and lower wages compared to Western countries, Chinese manufacturers can maintain much lower labor costs, which is a major advantage in large-scale vehicle production.

These differences in production costs explain why Chinese automakers, like BYD, are able to offer electric vehicles at a much lower price point than their Western counterparts, giving them a significant competitive advantage in both domestic and international markets. This cost advantage, especially in the critical components like batteries and labor, allows Chinese automakers to produce high-quality vehicles while keeping prices affordable, making them a formidable force in the global EV market.

Save America’s Federal EV Tax Credit and EV Subsidies

The reason keeping an eye on EV sales and production in China is important is because it is definitive proof that EVs are rapidly becoming the dominant force in the global automotive industry. America’s automotive OEMs are less able every passing year to compete globally with China’s low vehicle prices, due to the country’s low production costs. America must subsidize its automotive industry to survive and compete.

The federal EV tax credit and EV subsidies are important because they are crucial to helping American automakers catch up to China and compete with China, by producing EVs, hybrids and gas cars made in America. This is important to remember even for EV critics, as the EV credits and subsidies also help companies produce the gas cars that these critics prefer. Removing the credit and subsidies would be a disaster for America’s economy, losing American jobs in significant numbers. The American automotive industry would shrink drastically, with automotive sales confined to its own borders. At EVinfo.net, we urge you to contact your government representatives and save the federal EV tax credit and EV subsidies, saving America’s automotive industry and jobs.

Derek Kerton, Chairman, Cleantech Council, agreed with EVinfo.net that the federal EV tax credit and EV subsidies are crucial to helping American automakers catch up to China and compete with China.

“If we decide that we want to have a domestic car industry, with all its wealth creation, jobs, and long supply chain, we will need to help our domestic carmakers (yet again) catch up and position themselves for global competition,” said Kerton.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services