ICE Vehicle Sales Fall Below 80% in US for 2024, for First Time in History

2024 was a very exciting time for the EV revolution in America. Despite EV sales growth slowdowns reported throughout last year, 2024 finished very strong for fully electric vehicles and hybrids. Auto sales overall grew 2% from 2023.

In 2024, sales of all-electric vehicles (EVs) and hybrid models in the U.S. reached a significant milestone, accounting for 20% of all new car and truck sales, marking a notable year for the adoption of “green” vehicles. According to data from auto firm Motor Intelligence, reported by CNBC, more than 3.2 million electrified vehicles were sold last year, with 1.9 million being hybrids (including plug-in models) and 1.3 million being all-electric vehicles.

Traditional gas and diesel-powered vehicles still made up the majority of sales, though their share dropped to 79.8%, falling below 80% for the first time in modern automotive history.

Tesla’s annual sales and market share declined, with its share dropping to around 49% in 2024 from 55% in 2023. Following Tesla in the EV sales rankings were Hyundai Motor (including Kia) with a 9.3% market share, General Motors at 8.7%, Ford at 7.5%, and BMW at 4.1%.

The EV market is becoming increasingly competitive. Of the 68 mainstream EV models tracked by Cox Automotive’s Kelley Blue Book, 24 models saw year-over-year sales increases, 17 were new to the market, and 27 experienced sales declines.

Looking ahead, the future of EV sales remains uncertain, especially with the potential changes in policy under the new administration. Currently, federal incentives—such as a credit of up to $7,500 for purchasing EVs—support the market, but there is speculation that these incentives may be reduced or eliminated under the new administration.

Despite these uncertainties, Cox Automotive projects that 2025 will set a new record for EV sales, predicting that 10% of all new vehicle sales will be EVs, and that electrified vehicles (including hybrids) will make up about one-quarter of all vehicles sold this year.

EVinfo.net is confident that EV sales in America will keep rising, despite any actions by the new administration. We expect a sales growth slowdown if the EV tax credit is cut, however, we expect EV sales to bounce back up within one or two quarters after that. See why EVinfo.net supports saving the EV tax credit.

U.S. Auto Sales Beat Expectations in 2024

New-vehicle sales of all types in 2024 reached approximately 16.0 million, marking an increase of just over 2% from 2023, according to estimates from Cox Automotive’s Kelley Blue Book. This represents the best year for vehicle volume since the pandemic. The total sales figure exceeded Cox Automotive’s initial forecast, with nearly every automaker showing year-over-year growth, except for Stellantis and Tesla. General Motors emerged as the top-selling automaker for the year, while both Honda and Mazda saw strong growth in their sales. Retail sales were particularly robust at the end of the year, contributing to the strong overall performance in the new-vehicle market.

EV Sales in Canada Pass 10% in 2024

According to industry reports, electric vehicle sales in Canada reached over 10% of total vehicle sales in 2024, marking a significant milestone for the country’s EV adoption. This represents a continuation of the upward trend in EV sales, which saw 7.7% of all vehicle sales in Canada being electric in 2023.

Several electric vehicle models were particularly popular in Canada in 2024. Automakers like Ford, Hyundai, Chevrolet, and Volkswagen saw strong sales. Models like the Ford Mustang Mach-E, Chevy Bolt EV, and the Hyundai Ioniq 5 gained traction among Canadian consumers, further expanding the variety of options available in the electric vehicle market.

Government incentives at both the federal and provincial levels have continued to play a significant role in driving EV adoption. The federal government offers rebates of up to $5,000 for qualifying electric vehicles, and provinces like British Columbia and Quebec have implemented their own rebate programs, helping reduce the upfront cost of EVs.

Moreover, the continued expansion of the EV charging network in Canada has alleviated one of the key concerns for potential EV buyers: range anxiety. A greater number of charging stations, including fast chargers and home charging solutions, have made it easier for Canadians to own and operate electric vehicles.

In 2024, many automakers reaffirmed their commitment to electrification by launching new EV models and increasing their investment in electric vehicle production. This has resulted in a broader range of affordable and high-performance options, catering to different consumer needs and budgets.

Looking forward, experts predict that EV sales will continue to climb in Canada, with the market share potentially surpassing 15% by 2025.

EVs accounted for 4-5% of total vehicle sales in Mexico in 2024

In 2024, electric vehicle (EV) sales in Mexico saw notable growth, marking a turning point for the country as it navigates its transition to more sustainable and cleaner transportation. The increase in EV adoption is driven by a combination of government incentives, increased availability of electric models, and a growing awareness of the environmental benefits of electric mobility.

EVs accounted for around 4-5% of total vehicle sales in Mexico in 2024, compared to approximately 2-3% in 2023. Over the past year, electric vehicle sales in Mexico increased by more than 60%, showing a significant acceleration in adoption.

Several factors have contributed to the increasing sales of electric vehicles in Mexico in 2024.The Mexican government has introduced various incentives and regulations to encourage the adoption of electric vehicles, including tax breaks, reduced registration fees, and exemptions from certain taxes for EV buyers. Some local governments offer financial incentives for consumers purchasing electric cars, such as rebates for the purchase price of EVs.

As part of its commitment to reducing emissions, Mexico has set ambitious goals for increasing the adoption of electric vehicles in the coming years, aiming to reduce the environmental impact of its transportation sector.

In 2024, several major automakers have launched or expanded their lineup of electric vehicles in Mexico, offering both affordable models and high-end options. Automakers like Chevrolet, Nissan, BMW, and Volkswagen have introduced more electric options that appeal to a wider range of Mexican consumers.

One of the critical challenges for EV adoption is the availability of reliable charging infrastructure, and Mexico has been making strides in this area. In 2024, there was significant investment in the expansion of EV charging stations, both in urban areas and along highways, making it more convenient for consumers to own and operate electric vehicles.

As concerns about air pollution and climate change grow, more consumers in Mexico are turning to electric vehicles as a cleaner alternative to traditional gasoline-powered cars. In urban centers like Mexico City, air quality is a significant concern, and EVs are seen as part of the solution to reduce emissions and improve air quality.

Looking forward, the EV market in Mexico is expected to continue growing at a rapid pace. Experts forecast that by 2030, electric vehicles could make up as much as 15-20% of total vehicle sales in the country, driven by further government incentives, an expanding vehicle lineup from automakers, and continued investments in charging infrastructure.

The Vital Role of EV Charging in EV Adoption

EV charging has played a vital role in the growth of EV adoption. Public charging is a very important part of the industry. Charging at home is most convenient and cost-effective, however many EV drivers do not have access to a private parking space like a garage or driveway where they can install a home charger. Many U.S. households are multi-family housing, where charging access is often limited or nonexistent. The National Association of Home Builders reported that according to a 2019 survey conducted by the American Housing Survey and the U.S. Census Bureau, approximately 31.4% of housing in the U.S. today is multifamily.

BNEF’s “The State of EV Charging, No Pain, no Gain”

“The State of EV Charging, no pain, no gain” was presented by BNEF at its Summit in San Francisco, California, on February 5, 2025. BNEF’s Ryan Fisher made the presentation.

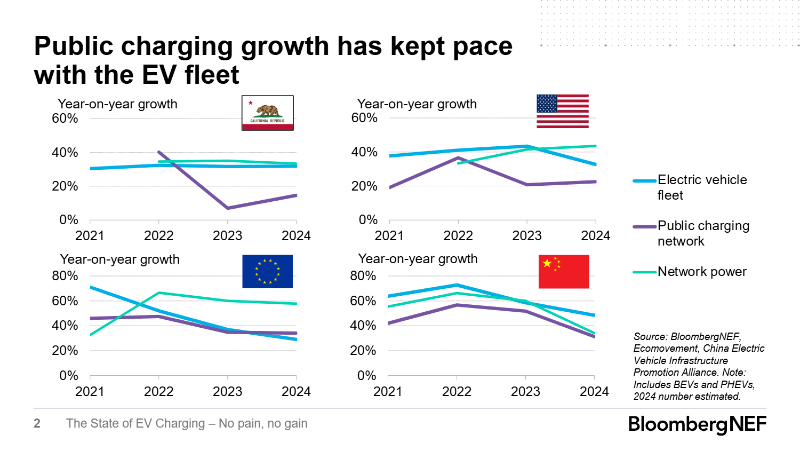

The presentation’s title, “no pain, no gain,” possibly referred to the ups and downs of the electric vehicle revolution worldwide and in the United States, and the barriers, or “pain” that early EV adopters have faced, particularly with EV charging. BNEF’s presentation included a section on how public EV charging growth has kept pace with the EV fleet. Year-on-year growth was studied for California, the US, Europe and China from 2021 to 2024. In the US, the number of EVs in year-on-year growth dipped from 40%, 2023-2024, while the public charging network made slight gains, so that the two became nearly aligned by the end of 2024.

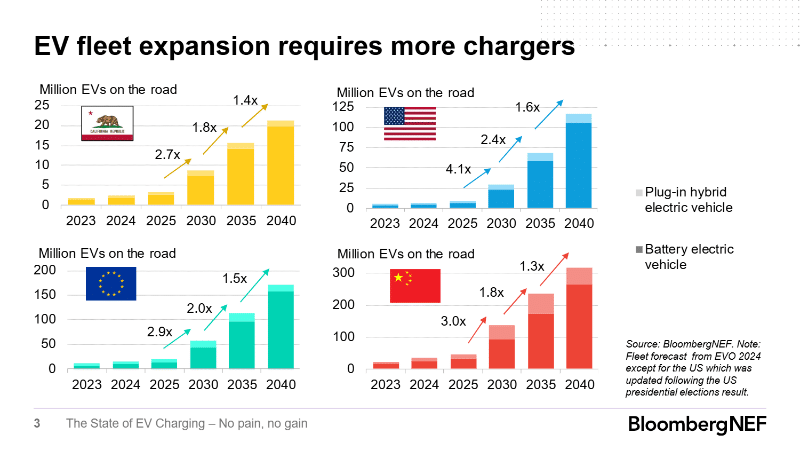

BNEF’s presentation also included the need for more chargers, as the EV fleet expanded. From 2023 to 2040, California, the US, Europe and China were studied in a projection from 2023-2040. In the US, the number of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) were predicted to closely approach 125 million on the road by 2040.

Ohm Analytics Q4 2024 US EV Charging Market Report: Insights and Trends in the Commercial and Residential Sectors

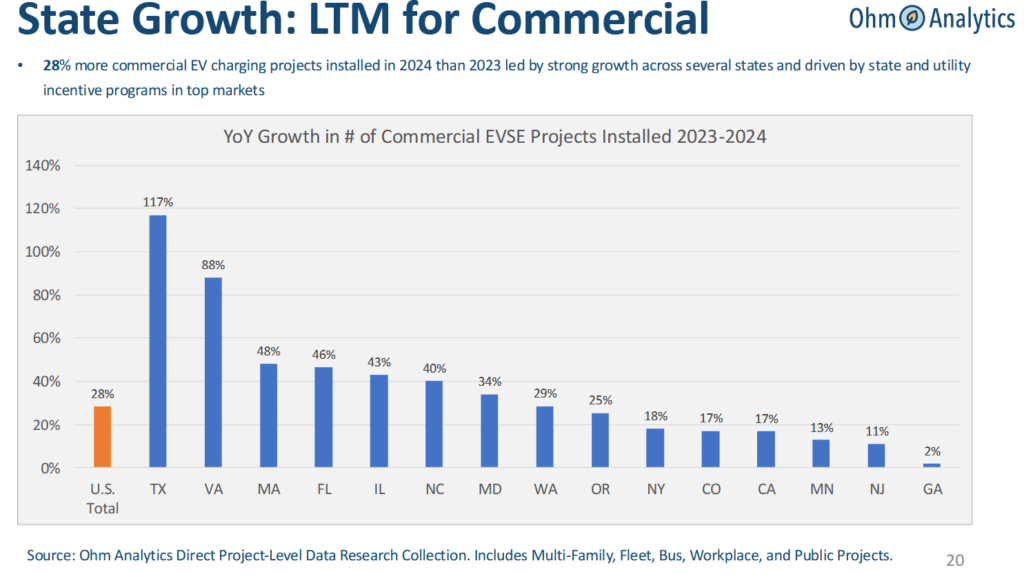

The “Q4 2024 US EV Charging Market Report” from Ohm Analytics provides a comprehensive look at the current state of electric vehicle (EV) charging infrastructure. Despite some uncertainties at the federal level, the overall market continues to see significant growth, particularly in the commercial sector. Here’s a breakdown of the key trends and insights from this report.

Commercial Market Highlights

Strong Year-over-Year Growth: The commercial EV charging market saw a solid Q4 2024 with a 55% increase in Level 2 (L2) ports and a 31% increase in Level 3 (L3) ports compared to the same period last year. This indicates an accelerating demand for both standard and fast charging options across various industries.

Quarter-over-Quarter Growth: The number of ports installed in Q4 2024 increased by 2% compared to Q3 2024, highlighting consistent growth in the market despite ongoing challenges.

Fleet and Multi-Family Focus: A significant portion of commercial installations came from fleet and multi-family charging, which accounted for 67% of all commercial ports installed in Q4. This aligns with the ongoing trend of electrifying fleets and making charging more accessible to residents of multi-family properties.

Momentum Heading into 2025: With a record number of installations in 2024, particularly in the fleet and multi-family verticals, there is a strong positive momentum heading into 2025. Notably, the number of chargers at multi-family properties is expected to surpass the total number of public chargers by late 2025, further expanding access to charging for urban EV owners.

Federal Funding Uncertainty: The change in administration has temporarily put new federal funding through the National Electric Vehicle Infrastructure (NEVI) program on pause. However, state and utility-level incentive programs are still playing a critical role in driving the market’s growth.

Residential Market Insights

Decline in Residential Installations: The residential sector saw a slight 3% YoY decline in installations in Q4 2024. There was also a 1% QoQ decrease compared to Q3 2024, reflecting some uncertainty in the residential EV charging market.

Uncertainty Around EV Tax Credits: One of the key factors impacting the residential market is the uncertainty around EV tax credits. Legislative efforts to remove the $7,500 tax credit for new EVs and the $4,000 credit for used EVs have created concerns, potentially dampening consumer enthusiasm for EV adoption.

Federal EV Sales Target Revoked: The Biden administration’s ambitious goal of having 50% of new car sales be EVs by 2030 has been revoked, leaving the future of EV adoption at the federal level in a state of flux.

Policy and Market Developments

Pause in Federal Funding Programs: The halt in federal funding programs, especially NEVI, has drawn considerable attention. While this pause has created some uncertainty, state and utility-level funding continues to support the market, particularly for multi-family charging projects.

Utilities Driving Multi-Family Charging: With several large DC fast charging programs reaching their funding limits, utilities are pivoting towards multi-family and Level 2 (L2) charging programs, which have become a key focus area for expansion.

End-of-Year Funding Push: There was a strong push for federal, state, and utility-level funding as 2024 came to a close. This push resulted in increased project counts and greater momentum for charging infrastructure development as more funding became available.

Outlook for 2025 and Beyond

Looking ahead, the outlook for the EV charging market remains positive despite the ongoing challenges in the federal landscape. The commercial market, particularly for fleet and multi-family charging, is expected to continue growing rapidly. Meanwhile, the residential market may face short-term hurdles related to tax credits and federal policy changes, but state and utility-level programs remain a reliable source of support for both commercial and residential installations.

The 2025 landscape will likely see further developments in multi-family charging, with multi-family properties becoming the leading sector for new charger installations, especially in urban areas. With continued investments at the state and utility levels, the push for more accessible, reliable, and fast EV charging infrastructure is set to drive further adoption of electric vehicles across the United States.

While federal funding uncertainties and policy changes pose some challenges, the commercial EV charging market remains on a strong growth trajectory, particularly in multi-family and fleet installations. With continued support from state and utility programs, 2025 looks promising for the EV charging infrastructure sector.

Autel Energy: Leading the Charge with Innovative EV Chargers

Autel Energy is making waves in the electric vehicle (EV) charging market with a diverse range of innovative and reliable charging solutions. Their offerings include impressive Level 2 home chargers, commercial charging solutions, and ultra-fast DC chargers. Autel’s 120kW dual-port MAXI Chargers, installed by Inovis Energy in Massachusetts in the photo below, are one example of many Autel EV charging installations around the United States.

Autel’s high-quality products are designed for various users, from homeowners seeking efficient home charging to businesses looking for robust workhorses to enable their fleets and operations. These chargers feature smart capabilities like Wi-Fi connectivity, mobile app integration, and customizable charging schedules, allowing users to easily monitor and optimize their charging experience.

What sets Autel Energy apart is its commitment to durability, fast charging speeds, and a partner ecosystem showcasing industry leading network interoperability, turnkey solution providers, and charge point operators. Their chargers are built to withstand harsh conditions and provide reliable, long-lasting performance. With a focus on sustainability and cutting-edge technology, Autel’s chargers are positioned to meet the growing demand for EV infrastructure, offering solutions that cater to both residential and commercial needs. As the world embraces electric vehicles, Autel Energy is paving the way for a greener, more efficient future in EV charging.

Upcoming Event: EV Charging Summit and Expo

Don’t miss Autel’s exciting display of its newest products and services at the EV Charging Summit and Expo, March 25-27, Las Vegas. Visit Autel at Booth 547.

The EV Charging Summit is a pivotal event that brings together industry leaders, innovators, and policymakers to explore the future of electric vehicle charging infrastructure.

About Inovis Energy

Inovis Energy serves a diverse range of industries across both the private and public sectors, including commercial, industrial, education, healthcare, hospitality, and municipal & local government. The company specializes in developing customized solutions tailored to meet the unique needs of each client, focusing on energy efficiency, EV charging, and renewable energy. Visit

https://www.inovisenergy.com for more information.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services