Gas Cars Are Disappearing Before Most People Realize

The U.S. electric vehicle market showed continued and impressive momentum in the first quarter of 2025. According to Kelley Blue Book, EV sales increased 11.4% year-over-year, reaching nearly 300,000 units. Electric vehicles accounted for 7.5% of all new vehicle sales, up from 7% during the same period in 2024, signaling a steady rise in adoption across the country.

The growth was driven by a wave of new models across several brands. Automakers including Porsche, Toyota, GMC, Volvo, Chevrolet, Ford, and Volkswagen all posted strong sales increases, while General Motors nearly doubled its EV sales compared to the prior year.

There were also regional variations. California, often seen as a bellwether for EV adoption, reported a decrease in zero-emission vehicle sales in the first quarter of 2025, based on data from the California Energy Commission. By contrast, global sales surged — up 29% year-over-year — with 4.1 million EVs sold worldwide in the first quarter, according to Rho Motion.

Taken together, these numbers show that while electric vehicle demand is still on the rise, the landscape is becoming more competitive and nuanced. With new entrants gaining market share and regional sales trends diverging, the years ahead will continue to shape the future of electrification in the U.S. and around the world.

EVs Represent About 1.4% of the Total 292.3 Million Cars and Trucks Registered in the US in 2024

Despite the continued fast growth of new EV sales, critics frequently point out that the total number of EVs on American roads is small. According to a recent report from Experian Automotive, there are approximately 4,092,200 electric cars on the road in the U.S. in 2024. That accounts for only 1.4% of the nation’s total 292.3 million cars and trucks, but it’s a notable jump from 2 million EVs in 2022 and just 1.3 million in 2021. The upward trend is projected to continue, with the National Renewable Energy Laboratory predicting that the U.S. could have between 30 million and 42 million EVs on the road by 2030.

Although these figures demonstrate a significant increase in EV adoption, they don’t paint the whole picture. A deeper look into sales data offers further insights into how this market is evolving. From January to February 2025 alone, U.S. consumers purchased 185,992 EVs, accounting for roughly 7.9% of all new vehicle purchases, according to Edmunds. Looking back at the full calendar year of 2024, EV sales totaled 1,233,458, surpassing the 1,077,138 electric vehicles sold in 2023 and representing a substantial leap from the 54,179 EVs sold in 2015. Meanwhile, gas-powered vehicles still held the lion’s share of sales last year, with 12,913,339 units sold, although fully gas-powered vehicles declined to 79.8%, falling under 80% for the first time in modern automotive history.

Ups and Downs Will Continue

Despite the rapid rise of EVs over the past decade, the rate of growth appears to be tapering currently. Edmunds analysts report that the transition toward full battery-electric cars has slowed recently, as many U.S. consumers still prefer the convenience and familiarity of hybrid powertrains. This shift in buyer preference may moderate EV sales in the near future — a reminder that while the EV market is undeniably on the upswing, its path to mainstream dominance will take time.

However, the current sales growth slowdown in EV sales does not concern us here at EVinfo.net. We still predict EVs to become the dominant vehicle type, given enough time.

EVs, like every other product, go through cycles of adoption that reflect changes in technology, pricing, consumer confidence, infrastructure, and even policy. The early boom in electric car sales was driven by innovation, tax credits, and a growing interest in sustainability. But as we’re seeing now, that rapid pace of growth doesn’t necessarily continue unchecked forever — it will naturally rise and fall with market conditions, just like any other industry.

That’s part of the maturation process for EVs. Just as traditional gas-powered cars experienced their own waves of growth and plateauing over the past century, electric vehicles will follow their own cyclical patterns over time. What matters most is that the long-term trajectory is still upward as new models, better battery tech, and more accessible charging continue to emerge.

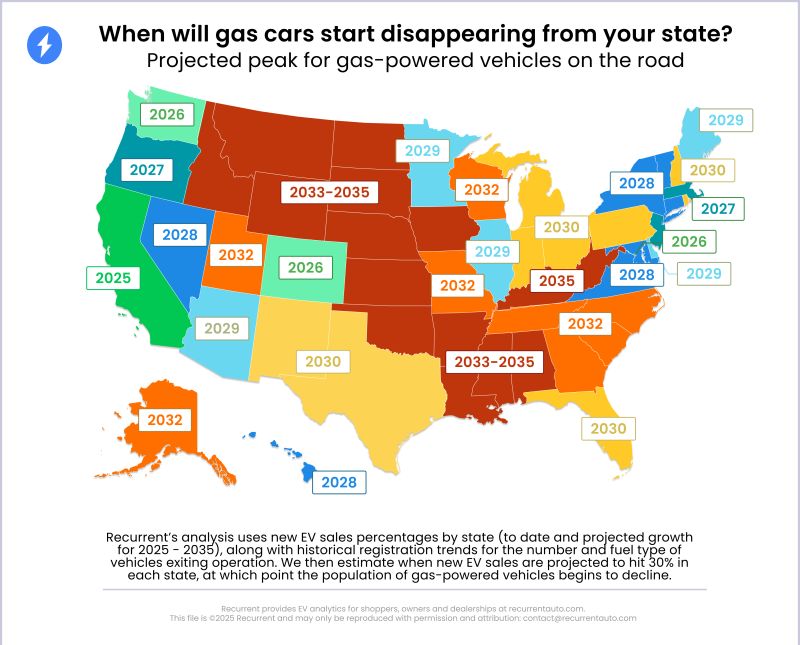

Recurrent Predicts When Gas Cars Will Disappear

Scott Case, Co-Founder and CEO at Recurrent, released Recurrent’s predictions on LinkedIn about when each state’s gas cars will begin to drop in numbers of vehicles on the roads.

Gasoline cars will begin disappearing faster than most people realize. According to data from Recurrent, California will have fewer gas-powered cars on the road starting next year — and every year after that — with Colorado and Washington reaching this tipping point by 2026. The math reveals that once new EV sales hit about 30% in a state, gas car numbers begin to drop.

“It’s a little counterintuitive that it’s not 50% when that happens — almost like one of those trick logic problems on the SATs, so here’s how the math works…,” said Case.

This counterintuitive threshold happens because of vehicle turnover: about 12 million gas cars leave the road each year, and 16 million new cars are sold annually. Since the vast majority of retirements are gas cars, reaching 4 million EV and plug-in hybrid sales per year nationwide is enough for gas-powered cars to decline — something projected to occur nationwide as early as 2029. The upshot? Gasoline sales and oil-change revenues will start shrinking much sooner than most people expect.

Peak Gas Car Production Happened in 2017

Americans will never again buy as many internal-combustion-powered cars as they did in 2017, according to a 2023 analysis from Bloomberg New Energy Finance (BloombergNEF), and reported by Kelley Blue Book. Even as global auto sales rebound after pandemic disruptions and supply chain shortages, analysts say gas-powered vehicle sales are unlikely to ever reach pre-2020 levels.

That’s a big shift for both the auto and oil industries. Until recently, most oil demand forecasts assumed that gasoline-powered cars would continue their dominance well into the 2030s. “Forecasts for oil demand issued just a few years ago still assumed steady growth,” BloombergNEF notes. But as consumer habits change, that looks less and less likely.

While price and convenience still hold some buyers back, EVs are on track to reach cost parity with gas-powered cars in the next few years. When that happens, one of the most significant hurdles to widespread adoption will disappear.

Back in 2017, global sales of gas-powered cars hit a high of 86 million units. By 2022, those sales had declined by almost 20% to 69 million — while plug-in vehicle sales had surged to 10.4 million.

For automakers and oil companies alike, these trends signal that the era of record-breaking gasoline car sales is in the past — and the future belongs to battery electric.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services