Future Energy’s 2024 EV Charging Infrastructure Study Has Valuable Dealership Insights

Future Energy, in partnership with Automotive News’ Content Studio, released its 2024 EV Charging Infrastructure Study in August 2024. The comprehensive, thought-leading study highlighted a host of valuable insights for the automotive dealership industry when considering or managing electric vehicle (EV) charging installation. Findings revealed that dealerships were far better off by working with a managed service provider for EV charging installation and management.

Download your copy of the study here.

Sam DiNello, CEO, Future Energy, said: “The real journey begins after the EV infrastructure is installed.”

The survey explored in detail how dealerships are adapting to growing electric vehicle (EV) infrastructure demands. With 371 franchised dealerships responding, the survey revealed that dealers are navigating significant challenges, including upgrading electrical capacity and installing EV chargers. Many dealerships have learned to streamline this process by partnering with energy management services like Future Energy, which help them not only install but also manage and optimize their EV infrastructure investments for long-term benefits.

EV Industry and EV Charging Challenges

Most dealerships surveyed have already installed EV chargers and plan to expand their infrastructure within the next two years. While many installations were driven by OEM requirements, some dealers also focused on staying relevant in the market and attracting new customers by installing EV chargers. However, when asked about the importance of EVs and the auto industry’s shift to electrification, leaders gave surprising answers, showing that the overall enthusiasm for EV adoption varies across dealerships despite the growing consumer interest.

Satisfaction With Current Charging Infrastructure, Future Plans

Dealerships rated their satisfaction with current charging infrastructure based on factors like cost and usage. Many anticipate adding more charging stations in the next two years, while others, although not planning to expand the number of chargers, intend to upgrade their existing infrastructure to better meet future demand. This highlights a broader trend of dealerships adjusting to the increasing presence of electric vehicles on their lots and in service departments, preparing for a future with greater EV adoption.

Factors Influencing the Decision to Install EV Charging

Dealerships install EV charging infrastructure for various reasons, including meeting OEM requirements, staying relevant in the market, and attracting new customers. Financial incentives, rebates, and tax credits also motivate some, while others see it as an opportunity to demonstrate commitment to sustainability or respond to existing customer demand. Additional factors include improving operational efficiency, boosting customer loyalty, responding to employee feedback, providing value to fleet clients, and creating a new revenue stream. Each factor plays a role in shaping their investment decisions, and the study highlighted stats on each.

Struggles and Frustration with ROI from Installing EV Charging

Many dealers are feeling disillusioned with current EV sales trends, expressing frustration over their investments in charging infrastructure, which they feel hasn’t delivered expected returns. Some report that their chargers are underused or have had little impact on business.

Despite this, plug-in hybrid (PHEV) and battery electric vehicle (BEV) sales are gradually increasing as a portion of monthly sales, though not yet enough to offset the initial infrastructure costs for some dealerships. In the survey, dealers rated their satisfaction with their dealerships’ current charging infrastructure on a scale from 1 to 10. See the study for how dealerships reported their satisfaction.

Installation Delays and Approaches to Installation

Delays and the length of time involved with installing EV charging is a pervasive issue across the EV charging industry. Some surveyed dealers said installing chargers and upgrading electrical infrastructure to handle them has been expensive, time-consuming and frustrating.

Dealers reported different approaches to setting up their EV chargers and infrastructure. Some worked with local electricians for installation, while others collaborated with their OEM or used contractors recommended by the OEM. Additionally, a number of dealerships partnered with energy services companies or EV managed service providers to handle the setup and management of their charging systems. These varied methods reflect the range of support options available as dealerships navigate the complexities of establishing EV infrastructure. The study provided detailed stats on how each installation was completed.

Gary Brown, president of Brown’s Chrysler-Dodge-Jeep-Ram and Brown’s Alfa Romeo in Patchogue, New York, said he has a Level 3 charger at the dealership ready to install but has waited more than eight months for permits from his municipality.

“In my area, we’re finding that the townships are going slow,” Brown said. “They don’t know what to inspect or what the expectations should be in terms of safety.”

Usage of the Chargers Varies

The study revealed mixed responses regarding charger usage compared to expectations. Some dealerships reported lower-than-expected usage of their EV chargers, leading to frustration about the return on their investment. Others saw more activity than anticipated, particularly as electric vehicle sales began to gradually increase. However, a significant number of dealers noted that the usage of their chargers had little to no impact on their business so far, reflecting the varied pace of EV adoption across different regions and markets. See the study for more.

Total Cost of Ownership (TCO) of the EV Charging Installations

Dealerships gave a range of responses regarding the total cost of ownership of EV chargers. Some found the costs higher than anticipated, citing installation, maintenance, and energy usage as contributing factors. Others felt the expenses were in line with their expectations, especially when they had received financial assistance, rebates, or partnered with managed service providers. A few dealerships noted that ongoing operational costs, such as software updates and charger maintenance, were more substantial than expected, reflecting the evolving understanding of EV infrastructure investment.

Managed Service Providers Received Good Ratings

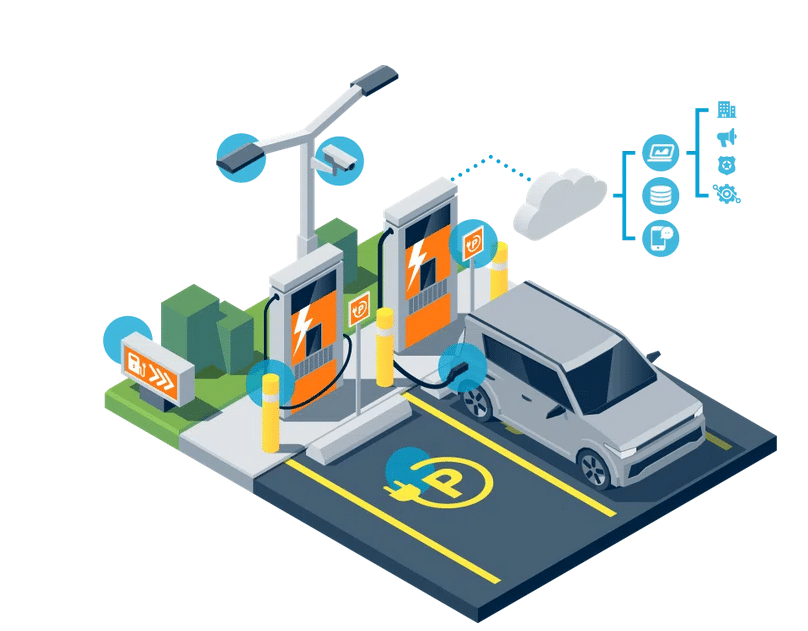

Dealers that utilized an EV managed service provider were more likely to experience positive outcomes from their investment in charging infrastructure. Future Energy is an EV managed service provider.

Challenges Encountered

During the installation of charging infrastructure, several challenges were encountered. These included delays while waiting for the utility to upgrade service, additional costs for the upgrade, and difficulties in coordinating efforts between partners and contractors. Some faced issues qualifying for or receiving financial assistance, rebates, or tax credits, and experienced delays in identifying the right site location. There were also problems with incorrect initial installation of chargers, managing the permitting process, and determining the optimal number of chargers to install.

Rating EV Capabilities of the Stores

A store’s expertise in managing charge states while in inventory, measuring data about the time to charge, and monitoring charging station uptime were examined in the study. Additionally, proficiency in measuring data on charging usage and demand, tracking the cost of each charge session, and incorporating the cost of charging into the total cost of goods sold were covered.

Expertise was rated as either “Not Very Capable” (beginner expertise), “Somewhat Capable” (intermediate expertise), or “Very Capable” (advanced expertise).

Sam DiNello, CEO of Future Energy Interviewed

In an engaging conversation, Automotive News host Emma Hancock interviewed Sam DiNello, CEO of Future Energy, to delve into the company’s forward-thinking approach to EV charging solutions. DiNello elaborated on how Future Energy supports dealerships in adapting to the increasing demands of electrification. During the discussion, he provided insights from Future Energy’s 2024 EV Charging Infrastructure Study, offering a glimpse into the evolving landscape of energy management in North America. DiNello’s reflections highlight the future direction of EV charging and energy management, and impacts of the EV transition on the automotive dealership industry.

Conclusions of Future Energy’s 2024 EV Charging Infrastructure Study

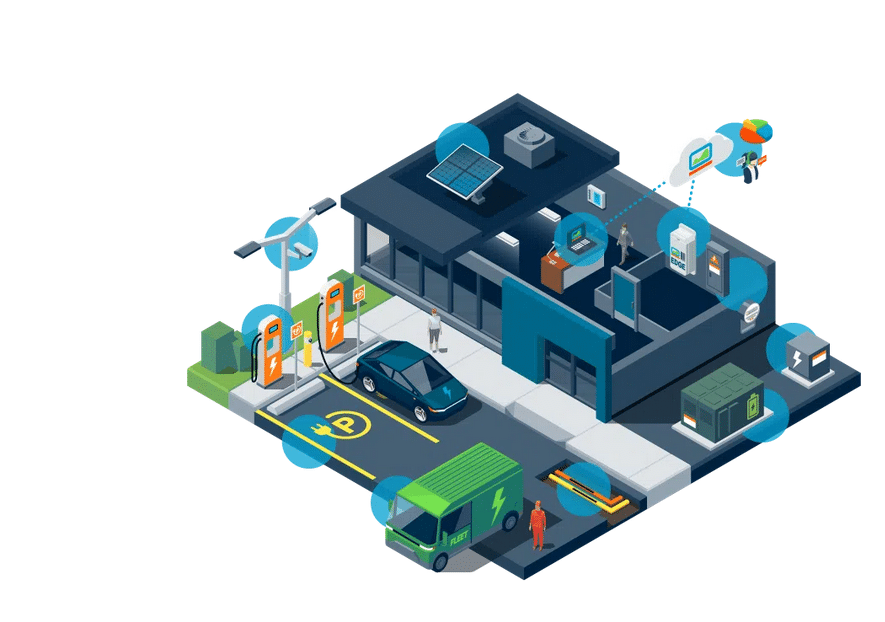

Dealers who collaborate with OEM-recommended contractors often find themselves more satisfied with their experiences and see greater benefits from having subject matter experts manage the complexities of electrification. The expertise of these professionals, coupled with genuine dialogue and information sharing, significantly aids in effective infrastructure planning and helps the sector transition to EVs more smoothly.

Gary Brown, a dealer from New York, exemplifies the advantages of this approach. He found that time and experience, supported by working with Future Energy, led to substantial savings.

For instance, Brown and his customers benefit from Future Energy’s real-time reporting software that provides insights into inventory charging and energy system performance. This investment in both hardware and software not only enhances customer service but also helps manage costs more effectively.

Contact Future Energy today, and download your copy of the study here.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services