What’s the Whole Story Behind the Honda and Nissan Merger?

On December 23, 2024, CNN reported that Honda and Nissan have officially agreed to initiate talks over the next six months regarding a potential merger. If the deal proceeds, it would create the world’s third-largest automaker, positioning the new entity as a formidable competitor to global car manufacturers like Toyota and Volkswagen. A key aspect of the deal involves Mitsubishi, a smaller Japanese automaker that is already allied with Nissan, which will also participate in the discussions.

This potential merger comes as a strategic response to increasing competition from Chinese automakers. Mergers in the automotive sector are not uncommon; historical examples, such as the formation of General Motors (GM) through acquisitions of various brands, show the long history of consolidation. However, merging large and diverse companies can often face challenges, particularly in integrating different corporate cultures and aligning business goals.

“Today marks a pivotal moment,” Nissan CEO Makoto Uchida said in a statement announcing the negotiations. “Together, we can create a unique way for (customers) to enjoy cars that neither company could achieve alone.”

Nissan has been facing significant financial struggles since the collapse of its alliance with Renault, which has left the company in need of a larger partner. For the six-month period ending in September 2024, Nissan’s profits plummeted by 94% compared to the same period in 2023. The company reported losses from its auto operations, with only a narrow profit stemming from its financing business. In response to these challenges, Nissan announced plans to cut its manufacturing output by 20%, leading to the layoff of 9,000 workers. Furthermore, it slashed its forecast for full-year operating profit by 70%.

Some analysts have warned that Nissan could face bankruptcy as early as 2026 due to a substantial amount of debt that will come due around that time. These financial struggles have made the potential Honda-Nissan merger especially crucial for Nissan’s survival and future stability.

The proposed tie-up between Honda and Nissan could spark further consolidation in the automotive industry, as companies increasingly seek to join forces to survive in a competitive market, particularly as they face rising threats from Chinese automakers. Adam Jonas, an auto analyst with Morgan Stanley, suggested in a recent note that this merger could be the catalyst for even more mergers across the industry in the coming years.

“Legacy auto companies that don’t find new partners must face the prospect of being smaller companies with higher capital expenditures, and research and development costs per (every vehicle sold),” wrote Jonas.

“Moreover, amidst a potentially broader consolidation era, the ones who chose not to participate effectively ‘get smaller.’ We’re entering a new phase of the auto industry where the strategies for scale and cost leadership put the focus on cooperation and potential changes in scope,” Jonas continued.

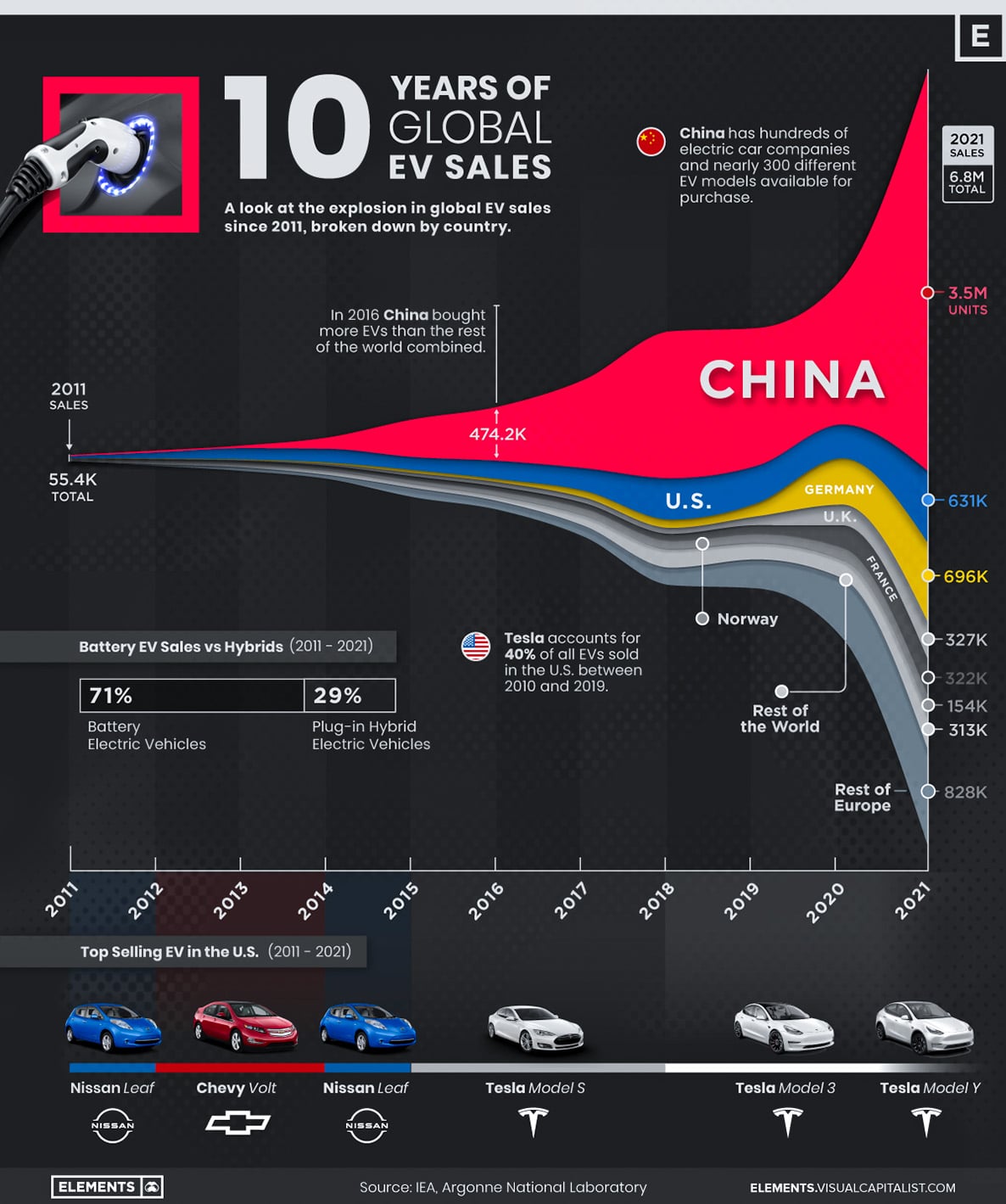

How China Took Over the Global EV Market

Honda and Nissan are not the only companies feeling pain currently. To tell the story of why their merger is happening, a broader analysis of the global automotive market is required.

In November 1994, Wang Chuanfu assembled a team of 20 people to establish BYD in Shenzhen. Wang recognized a significant opportunity in the evolving battery market, as Japanese companies began shifting from NiCd to more advanced and higher-value battery technologies, including nickel-metal hydride (NiMH) and lithium-ion (Li-ion) batteries.

BYD’s first lithium car was the BYD e6, a battery electric vehicle that began production in 2009. In 2024, BYD’s all-electric Seagull is among the world’s cheapest cars, at a price point lower than comparable gas models, selling for under $10,000.

This foresight in recognizing the growing demand for newer battery technologies played a pivotal role in BYD’s early success and eventual expansion into the electric vehicle (EV) market. BYD is now China’s largest automaker.

China saw the opportunity in the early 2000’s to dominate the global EV market and ran with it. This also allowed the country to dominate the global automotive industry, including internal combustion engine (ICE), EV, and hybrids.

China’s extensive and long-term investment in electric vehicles (EVs) has positioned the country as a dominant global leader in the EV market. Beginning in the early 2000s, China recognized EVs as a critical pathway to reduce dependence on imported oil and enhance energy security. Premier Wen Jiabao’s commitment to EV development, along with the appointment of Wan Gang, an experienced engineer with international credentials, set the stage for a policy-driven approach toward EV leadership. This initiative was heavily supported by the Chinese government through substantial subsidies, loans, and tax incentives.

China’s investment in the EV and battery sectors has been staggering, surpassing $230 billion since 2009. This investment not only fostered a thriving domestic market but also led to the rise of significant Chinese EV manufacturers such as BYD, NIO, and Xpeng, which have gained substantial market share.

China’s dominance in the global EV market is further reinforced by its vast manufacturing capacity. The country boasts numerous EV production facilities supported by state-backed infrastructure, which includes low-interest loans, tax incentives, and affordable land. These efforts have helped China establish itself as a key global supplier of EV batteries, a vital component of the electric vehicle ecosystem.

The combination of aggressive domestic policies and international expansion has made China a formidable force in the global EV market. Visual Capitalist’s infographic underscores this dominance, showing just how far ahead China is compared to other nations, with over 50% adoption of EVs by the end of 2024.

China’s EV Dominance Allowed Takeover of the Global Automotive Market

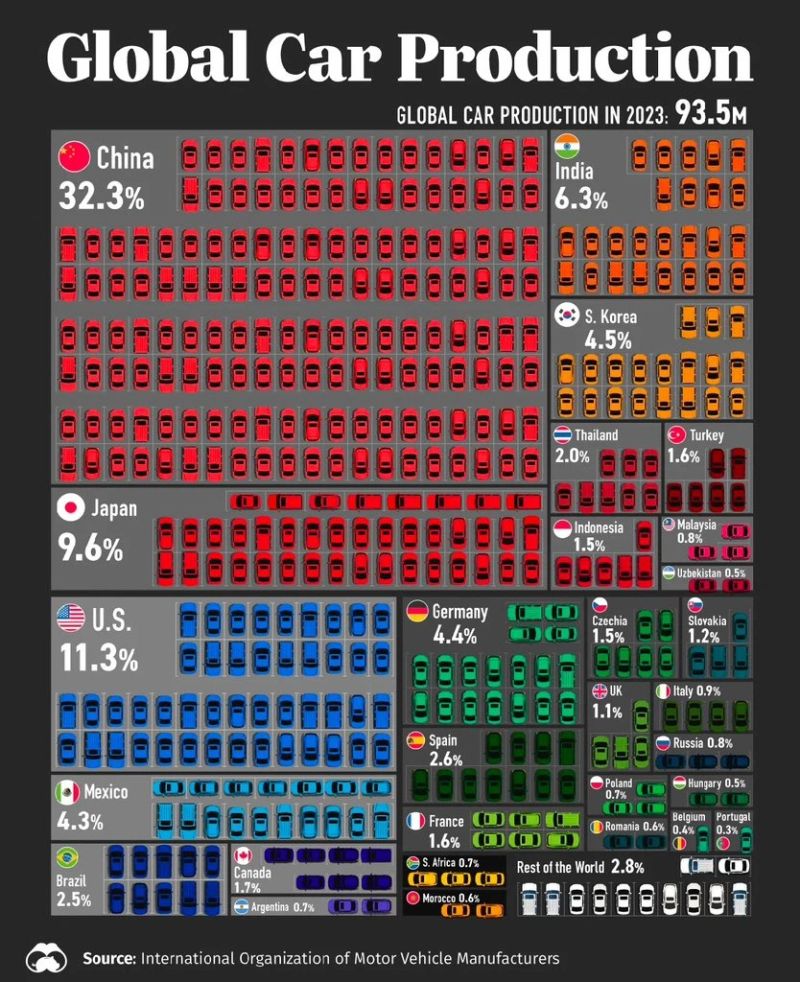

China’s dominance in the global car production market is a direct result of its leadership in electric vehicle (EV) manufacturing. With the world’s largest domestic car market and substantial government investment in automation, China has positioned itself as a global powerhouse in the automotive industry. The country’s rise to prominence is bolstered by its focus on EVs, where Chinese manufacturers, supported by heavy state-backed investments in research, development, and infrastructure, have secured a strong foothold both domestically and internationally. China’s aggressive policies have led to a rapid expansion of its EV market, allowing it to export more vehicles than any other country.

Despite facing recent economic slowdowns, which have resulted in overcapacity issues, China’s production capability remains formidable. With nearly double the production capacity required to meet domestic demand, China has solidified its position as a leader in automotive manufacturing. As of 2023, China produced 32.3% of the world’s cars, according to the International Organization of Motor Vehicle Manufacturers, a stark contrast to the United States, which produced only 11.3%.

China has made significant strides not only in electric vehicles (EVs) but also in the production of hybrid and gasoline-powered cars. While the country is best known for its rapid growth in the electric vehicle sector, its hybrid and gasoline car production remains a key part of its overall automotive landscape.

China has become a major player in the hybrid vehicle market, offering a wide variety of options for consumers. The production of hybrids has been spurred by government policies that promote more fuel-efficient and environmentally friendly vehicles as part of its broader strategy to reduce emissions and improve air quality.

Despite the rise of electric and hybrid vehicles, gasoline-powered cars remain a dominant force in China’s automotive industry. China is the world’s largest producer and consumer of gasoline-powered cars, a market driven by both domestic demand and exports. Major international automakers, including Volkswagen, Toyota, General Motors, and Ford, have long been producing gasoline-powered vehicles in China, and many Chinese automakers also have a large portfolio of internal combustion engine (ICE) vehicles.

China’s capacity for producing gasoline cars is immense, as the country has developed a highly competitive and efficient manufacturing base. The industry benefits from a combination of global and domestic players who have deep experience in producing mass-market vehicles. As of recent years, however, the country has been gradually shifting focus toward cleaner energy sources, including EVs and hybrids, to combat pollution and meet climate goals. Every foreign car seller in China has lost significant market share as the domestic supply of all automotive options grow.

In December, GM’s Chinese sales are down 19% over the first nine months of the year. It has lost $347 million on its Chinese joint ventures over the same period. Earlier this month, it announced its net income would be reduced by more than $5 billion due to the problems in China.

Western automakers tried to stay the course with gasoline-powered cars in China, and for the most part, so did their JV partners. Now those companies are trailing far behind in an effort to keep up with lower priced EVs and hybrids from Chinese automakers.

It was a massive miscalculation by Western automakers, said Bill Russo, head of Shanghai-based investment advisory firm Automobility.

“The foreign brands didn’t prioritize it. They didn’t see it coming,” said Russo. And they’re still losing money on EV production, even as Chinese competition eats up market share. “They thought they had time that they didn’t have,” Russo said.

Saving the EV Tax Credit and EV Subsidies are Important for America to Compete

The incoming administration is proposing cutting the EV tax credit, which will put the US farther behind, lose many auto jobs, and devastate the US economy. Join our fight to save the credit.

The Nissan Leaf, an Early EV Leader

Nissan had great success with its Leaf, launched in 2010, as one of the world’s first mass-market electric vehicles, marking a significant milestone in the automotive industry’s shift toward sustainability. Developed by Nissan as part of its efforts to reduce carbon emissions and address energy security challenges, the Leaf was designed to be an affordable, practical, and zero-emission car for everyday consumers. With a range of 73-100 miles on a single charge, it quickly gained attention and became the world’s best-selling electric car in its early years.

In the years following its debut, Nissan continued to improve the Leaf’s range and technology. In 2015, a new version was introduced with a 30 kWh battery, offering a range of around 150 miles. Later updates included a 40 kWh battery in 2018, further extending the range and refining the car’s design. By 2020, Nissan released a long-range variant of the Leaf with a 62 kWh battery, allowing for up to 226 miles on a single charge.

Over the years, the Leaf has helped shape the electric vehicle market and remains a popular choice for those seeking an affordable EV. Its success has also paved the way for more advanced electric models from Nissan, including the Nissan Ariya, which represents the brand’s shift toward electric crossovers. While it faces increasing competition from newer entrants, the Nissan Leaf’s legacy as a pioneering electric car continues to influence the industry. However, sales have sharply declined in recent years as newer, more powerful and attractive models from competitors have emerged.

Nissan’s CHAdeMO Charging Standard is Now a Big Problem

Charging compatibility is also an issue. Nissan’s Leaf EVs use the CHAdeMO standard for charging, which is less common in markets like the U.S., where the CCS (Combined Charging System) standard is more widely adopted. This disparity can make it harder for Nissan owners to find compatible chargers. Not converting the Leaf to CCS was obviously a big mistake.

The Leaf Needed a Facelift Long Ago

The design of the Nissan Leaf has been a point of criticism for several reasons, which have contributed to its struggles in appealing to a broader audience. One of the main issues is its relatively uninspiring and utilitarian design.

As Nissan looks ahead, its efforts to recover extend to the world of digital car design. One such effort is the work of Larson Design’s Lars Sältzer, a virtual artist who created a CGI concept for the third-generation Nissan Leaf.

These problems, as well as not releasing more EV models, plagued Nissan and brought it to the unfortunate position it holds today.

Honda Also in Trouble

Honda faces growing competition from China, particularly in the electric vehicle (EV) sector, as Chinese automakers continue to expand their global influence. China’s significant investments in EVs, driven by government subsidies and aggressive policy support, have positioned Chinese automakers, such as BYD, NIO, Xpeng, and others, as formidable players in the global market. These companies are rapidly scaling up production and improving the quality and affordability of their electric vehicles, challenging traditional automakers like Honda, due to their access to cheaper labor, government support, and economies of scale.

Additionally, China’s rapid advancements in battery technology and electric vehicle manufacturing have allowed companies like BYD to emerge as strong competitors on the global stage. Honda, which has been relatively slower to transition to electric mobility compared to some of its competitors, faces a challenge in catching up with the pace of innovation coming out of China. Chinese manufacturers also benefit from low-cost batteries and an extensive network of local suppliers, giving them a competitive edge in terms of both pricing and technology.

In response to this competition, Honda has accelerated its plans to expand its EV lineup, aiming to release more electric vehicles in the coming years. The company is also working to develop new partnerships with tech companies and expand its presence in China to strengthen its foothold in the world’s largest EV market.

The Honda Prologue EV is Selling Great in America

The Honda Prologue’s rise to prominence underscores the importance of strategic execution in overcoming challenges and achieving success in the competitive electric vehicle (EV) market. With 6,823 units sold in November and a total of 25,132 units sold year-to-date, the Prologue has gained significant traction in the American market.

Honda’s careful planning and focus on delivering a well-rounded EV—offering features that align with consumer expectations for performance, range, and affordability—has allowed the Prologue to make a strong entry. The model’s success can also be attributed to Honda’s growing commitment to electrification. However, it is obvious Honda should have moved much faster into EVs with many more models before now. The Prologue is Honda’s only EV currently for sale in the US, and is recommended by EVinfo.net.

Despite Honda’s success in America with its Prologue, it will need more EV models, and more competitive EV models, and very soon, as the competition intensifies. Honda will need to focus on innovation, cost efficiency, and enhancing its electric vehicle offerings to remain competitive, particularly in China and other growing EV markets around the globe.

Will the Honda and Nissan Merger Succeed?

The potential merger between Honda and Nissan is a bold move that could offer significant benefits for both companies, but its success in the face of China’s dominance in the global automotive industry remains uncertain. Chinese automakers, with their aggressive expansion in electric vehicles (EVs) and government-backed support, have become formidable competitors, making it a challenging environment for traditional automakers like Honda and Nissan.

One of the primary advantages of a Honda-Nissan merger would be the ability to pool resources, technology, and expertise, particularly in electric mobility. Both companies have committed to electrification, but neither has fully captured the market dominance that Chinese EV manufacturers like BYD and NIO have achieved. By combining their R&D efforts, production capabilities, and global distribution networks, Honda and Nissan could accelerate the development of competitive EVs and hybrids.

While Chinese automakers are rapidly expanding in their home market and beyond, Honda and Nissan maintain a strong global presence, particularly in North America, Europe, and Japan. The merger could help both companies expand their collective reach in regions where Chinese automakers are still growing their foothold. This is especially important in markets like the U.S., where the Chinese auto industry has yet to achieve the same level of dominance. If Honda and Nissan can leverage their established relationships and loyal customer bases, they could present a competitive alternative to Chinese-made vehicles.

Nissan and Honda already have substantial manufacturing capabilities and supply chain infrastructure, which would allow them to benefit from economies of scale, something that would be crucial in competing with the massive scale of China’s auto production. Despite China’s dominance in EV battery production, Japan remains a key player in this space, and Honda and Nissan could leverage local supply chains to reduce costs and improve the efficiency of their electric vehicle production. Furthermore, both companies have already made significant investments in automation and advanced manufacturing processes, which could help them stay competitive.

Despite these potential advantages, Honda and Nissan face several challenges in competing with Chinese automakers. Chinese companies benefit from substantial government subsidies, access to cheaper labor, and vast domestic demand, which enable them to produce affordable, high-quality EVs at scale. Additionally, Chinese companies have made massive strides in battery technology, an area where both Honda and Nissan are still catching up.

Moreover, Chinese automakers like BYD have already established strong brand recognition, especially in EVs, making it harder for Honda and Nissan to make inroads in these rapidly growing markets. Additionally, China’s domestic policies encourage the expansion of homegrown manufacturers, which might limit the ability of a merged Honda-Nissan group to capture significant market share in China.

To counter Chinese dominance, Honda and Nissan might need to forge additional strategic alliances with other global players. For instance, the merger could create opportunities for joint ventures with technology companies, startups, or battery suppliers to address the challenges posed by the rapid pace of innovation in the EV sector.

In conclusion, while the merger of Honda and Nissan could provide them with greater resources to compete against Chinese automakers, it will not guarantee success. The key to their ability to thrive in the face of Chinese auto dominance will lie in how effectively they can leverage their combined strengths in technology, global presence, and manufacturing capabilities. They must also overcome challenges related to innovation, battery technology, and competitive pricing.

Now is the time for all Nissan and Honda, along with all automakers to move faster into EV. That fact is blazingly clear, as the world’s automotive future is all-electric. The reason EVinfo.net says “gas is dead,” is because the world hit its peak of gas-powered vehicle production in 2017, and that has declined every year since then.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services