Geely Enters Australia and New Zealand, Completing Global Presence Across Five Continents

Geely Auto’s expansion into the Australian and New Zealand (ANZ) markets is a significant milestone in the company’s globalization strategy. On March 11, 2025, Chinese EV maker Geely officially launched its brand and the Geely EX5 SUV in these markets, completing its business presence across five continents. This marks a new chapter for Geely, as it aims to solidify its global footprint and enhance its distribution channels for the future.

The company is looking toward its 2030 Vision, with plans to further expand into markets like the UK, Brazil, and South Africa by the end of 2025. Geely plans to add over 300 new sales and service outlets, aiming to reach 1,100+ channels globally. Their mission of creating a “smart mobility experience that exceeds user expectations” is reflected in their growing customer base, which now exceeds 17 million worldwide.

The Geely EX5 has already captured international attention, with successful launches in Indonesia, the Philippines, and Costa Rica. Its international presence continues to grow, with its first overseas deliveries occurring in Thailand in March 2025. By the end of 2025, Geely plans to introduce the EX5 to over 20 global markets.

The EX5 is built on Geely’s GEA Global Intelligent Electric Architecture, which incorporates key technologies such as the Geely Short Blade Battery, CTB Structure, and an 11-in-1 Intelligent Electric Drive. Over the next three years, Geely intends to launch eight more new energy vehicle (NEV) models based on this platform, targeting various market segments and further solidifying its competitive edge in the global electric vehicle market.

China Winning While US Falters

EVs continue to sell well in America, the first two months of this year have seen a 30% growth in EV sales, according to Rho Motion, a market intelligence firm. While the growth of EVs remains strong, the future trajectory is uncertain. The administration has made moves to roll back the federal clean vehicle tax credits, which could slow the pace of adoption for many consumers.

Additionally, the administration has raised the prospect of imposing a 25% tariff on imports from Canada, and Mexico, a critical manufacturing hub for many EVs. Temporary tariff exemptions for Canadian and Mexican goods covered by USMCA were granted until April 2, to minimize disruption to the U.S. automotive industry and workers, however this has done little to allay fears of a coming recession. The tariff announcements caused a stock market crash, the S&P 500 has dropped from its record high as inflation and growth concerns rise.

A JP Morgan report predicted the chance of recession at 40%, up from 30% at the start of the year, warning that US policy was “tilting away from growth”, while Mark Zandi, chief economist at Moody’s Analytics, increased the odds of a significant recession from 15% to 35%, citing tariffs as the sole reason.

In 2024, the Biden administration increased the existing tariff in the US to a 100% tariff on Chinese electric vehicles, and a 25% tariff on Chinese lithium-ion EV batteries. These caused problems for the three Geely brands sold in the US, which are Volvo, Polestar and Lotus. However, these problems have not severely impacted sales of these brands in the US. These tariffs have only raised prices for American consumers, that is all.

No Greater Gift Could Be Given to the Chinese Automotive Industry Than the Current US Administration Policies

China benefits greatly from all of the administration’s current economic mistakes. While America’s auto market is important, its vital to not forget that America’s automotive companies, such as Ford and GM, count on international sales to stay profitable and competitive. The administration is making things far more difficult for Ford and GM, rather than easier.

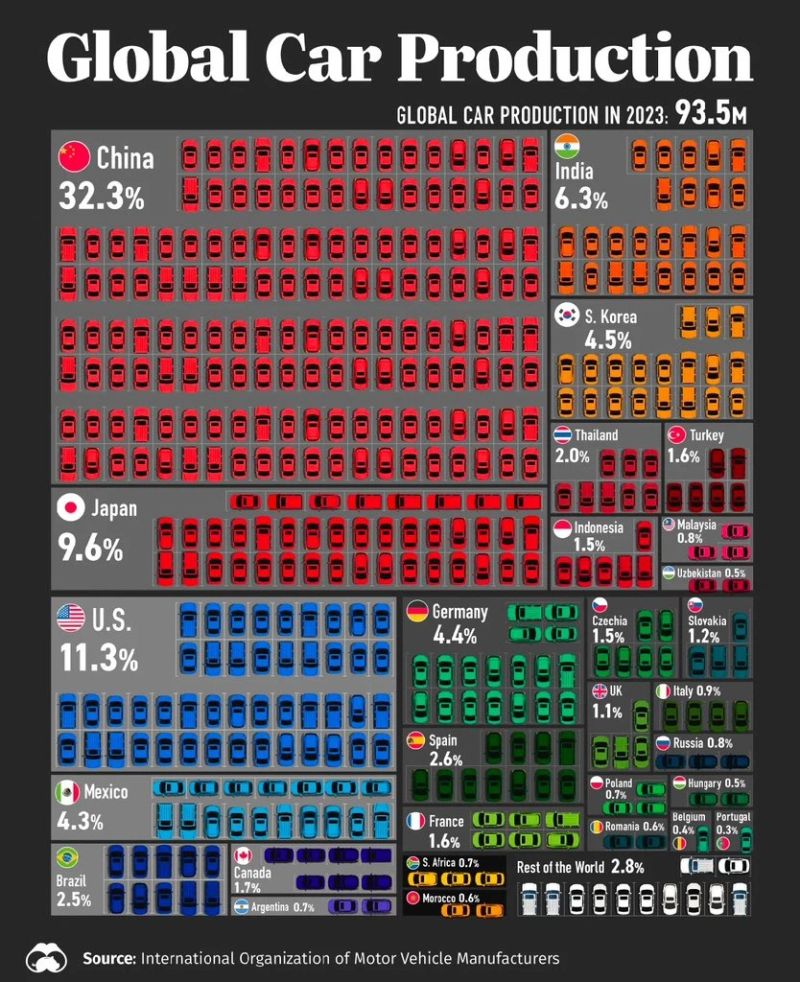

China produced 32.3% of the world’s cars in 2023, according to the International Organization of Motor Vehicle Manufacturers. In the infographic below, one can easily see how America is struggling to compete, at 11.3%.

China, the global EV and auto industry leader, is rapidly gaining global market share while the US is losing. One example is the Australian and New Zealand markets.

Save America’s Federal EV Tax Credit and EV Subsidies

The reason keeping an eye on Chinese expansion into new markets, for example Geely moving into Australia and New Zealand, is important is because it is definitive proof that Chinese EVs are rapidly becoming even more of a dominant force in the global automotive industry.

America’s automotive OEMs are less able every passing year to compete globally with China’s low vehicle prices, due to the country’s low production costs. It has never been more clear that America must subsidize its automotive industry to survive and compete.

Saving the federal EV tax credit and EV subsidies are important because they are crucial to helping American automakers catch up to China and compete with China, by producing EVs, hybrids and gas cars made in America.

As of this writing, federal EV charging funding for the National Electric Vehicle Infrastructure (NEVI) Formula Program remains frozen. If the US wants a strong and profitable auto industry, it must reverse course immediately on all of the tariffs and tariff threats, freezing NEVI funding, and the planned cut to the Federal EV Tax Credit. Otherwise, America’s automotive industry and economy will lose more for at least the next four years, while China wins even more. Is that making America great again? ABSOLUTELY NOT.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services