New 25% Tariffs on Imported Cars Bring Far Higher Prices for US Consumers

On March 26, 2025, the U.S. administration announced plans to impose a 25% tariff on all imported cars, intensifying the ongoing global trade war. This move comes just weeks after previous tariffs triggered a stock market crash and raised increased concerns about a potential recession.

On March 15, a JP Morgan report predicted the chance of recession at 40%, up from 30% at the start of the year, warning that US policy was “tilting away from growth”, while Mark Zandi, chief economist at Moody’s Analytics, increased the odds of a significant recession from 15% to 35%, citing tariffs as the sole reason.

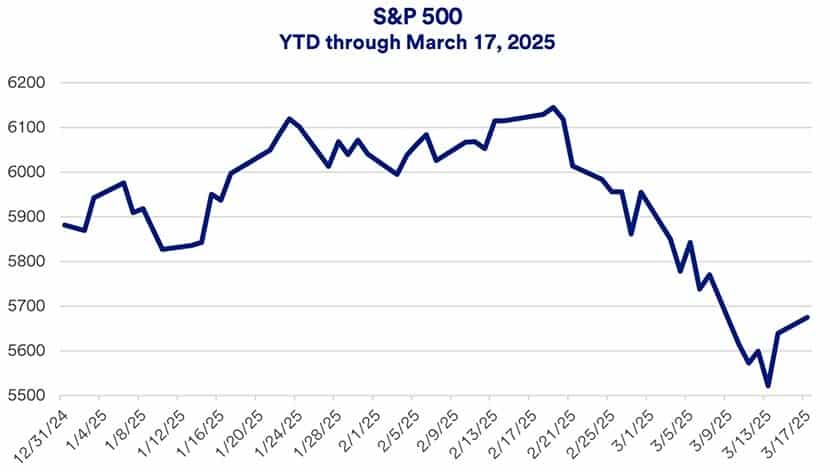

US Bank reported that for the first time since 2023, the S&P 500 had a devastating market correction on March 13, due to the tariffs. The index fell 10% below all-time peak levels reached a little more than three weeks earlier. The rapid decline caught many investors by surprise, particularly given the favorable underlying conditions U.S. stocks carried into 2025, as the economy was very strong as of January.

“Uncertainty is the driver around the market’s recent selloff,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management.

The 25% Tariffs Will Apply to a Wide Range of Imported Passenger Vehicles

Experts told ABC News the 25% automotive tariffs would put downward pressure on U.S. economic growth. The additional tax burden for importing businesses and uncertainty about additional duties in the future could deter private sector investment.

“A lot of the uncertainty about tariffs very likely has firms sort of frozen in place as they’re waiting to evaluate and see what happens,” Jason Miller, a professor of supply chain management at Michigan State University, told ABC News.

The 25% tariffs will apply to a wide range of imported passenger vehicles, including cars, SUVs, minivans, cargo vans, and light trucks. Additionally, key auto parts, such as engines, powertrain components, and electrical parts, will also be targeted. According to the White House fact sheet, 50% of the approximately 16 million cars purchased in the U.S. last year were imports. Of the 8 million vehicles assembled domestically, only about 50% of the parts used were produced in the U.S. This means that just 25% of the cars Americans bought were made with purely domestic content.

Why the Tariffs?

The administration claims that these tariffs are necessary to protect the U.S. auto industry, which it mistakenly views as critical to national security. The White House argues that excessive imports are undermining America’s domestic industrial base and supply chains, which is a protectionist viewpoint without merit. The U.S. currently imposes a 2.5% tariff on imported passenger cars and a 25% tariff on imported pickup trucks. This new round of tariffs is set to take effect on April 3 for cars and April 3 for auto parts, just one day after the planned reciprocal tariffs begin.

The Average Price of a New Imported Car Could Rise by $6,000, Used Cars and Insurance Rates Will Also Rise

The imposition of tariffs on imported vehicles is expected to have significant price repercussions. According to experts, consumers can expect car prices to rise, especially after dealerships deplete their existing inventory. While the tariffs won’t be directly added to the sticker price, as manufacturers and dealers have some flexibility in adjusting prices, the overall cost of new cars is anticipated to increase. ABC News reported industry analysts predict that the average price of a new imported car could rise by $6,000.

As new car prices climb, used car prices are also likely to see an increase, as higher prices for new cars trickle down through the supply chain. Additionally, experts forecast that car insurance premiums will rise in tandem with these higher prices.

Stephanie Brinley, a principal automotive analyst at S&P Global Mobility, noted that while 54% of cars sold in the U.S. last year were made domestically, many of the more affordable vehicles on the market come from Mexico. With the new tariffs set to affect this trade, the entire auto market, even for vehicles made in the U.S., will likely face price hikes.

Significant Negative Impact on North American Trade

The imposition of these tariffs also threatens to disrupt the longstanding free trade agreements between the U.S., Mexico, and Canada. Mexico and Canada are among the top U.S. trading partners, accounting for nearly $120 billion in motor vehicle imports in 2023. This includes finished vehicles as well as auto parts.

Under the United States-Mexico-Canada Agreement (USMCA), importers will be able to certify U.S. content for auto parts, but the 25% tariff will only apply to the value of non-U.S. content. This complicated framework is expected to create additional logistical challenges for auto manufacturers and suppliers.

The Canadian government, in particular, has voiced strong opposition to the tariffs. New Prime Minister Mark Carney labeled the move a “direct attack on our workers” and promised to convene a cabinet meeting to discuss potential trade responses. The Canadian Chamber of Commerce also criticized the tariffs, warning that they could lead to the loss of tens of thousands of jobs on both sides of the border. This disruption, they argue, could severely damage North America’s leadership role in the global auto industry and push companies to relocate production elsewhere.

The automotive industry tariffs follow a flurry of duties imposed by the administration earlier this month. Tariffs on China were imposed in early March, raising taxes on goods from China to 20%. Days later, sweeping tariffs on all aluminum and steel imports were imposed.

The tariffs prompted retaliatory tariffs from China, the European Union and Canada, setting off a global trade war. The trade war crashed the stock market and prompted warnings from Wall Street experts that the possibility of a recession is growing fast.

Economists widely expect these tariffs to raise prices for consumers not only in the US, but around the world, since importers typically pass along a share of the tax burden to shoppers.

Kyle Handley, a professor of economics at the University of California, San Diego, spoke about the tariffs, and said he expects consumer prices to rise enough for consumers to identify the change.

Handley said, “It will be a non-trivial increase in the price of imports. People will notice.”

At a press conference in Washington, D.C., last Wednesday, Fed Chair Jerome Powell faulted tariffs for a “good part” of recent inflation that the Fed reported.

The Impact on EV Sales

Considering that the tariffs will increase the price of all electric vehicles made outside the US, electrek reported on where all the electric cars available in the US are assembled. Notably, the Chevrolet Blazer EV and Equinox EV are produced in Mexico, as well as the Ford Mustang Mach-E. Some foreign EV models produced in the US include the Genesis GV70, Acura ZDX, Nissan Leaf, Volvo EX90 and Mercedes EQE.

Looking Ahead: More Tariffs on the Horizon

The U.S. tariffs on imported cars and auto parts are just the beginning. With tensions between the U.S. and its trade partners rising, more tariffs may be on the way, impacting not just the auto industry but also nearly all other sectors of the economy.

The question remains: will these protectionist measures truly safeguard the U.S. auto industry, or will they backfire and raise costs for American consumers while destabilizing the intricate trade relationships that support the North American auto sector?

As this trade war escalates, the global economy, consumers, and industries will be closely watching the administration’s next steps. One thing is certain: the negative impact of these tariffs will be felt for years to come.

EVinfo.net’s Take

Tariffs are the absolute worst way to accomplish bringing more automotive industry manufacturing and investments to the United States, and will most certainly backfire. The trade war is positioning America as a chaotic and unreliable business environment that other nations and foreign companies are running away from at an ever-increasing pace. All business around the world thrives on stability, and the US is very far from that under its current leadership.

Foreign automotive industry investment was already coming to the US, for example, Hyundai Motor Group announced a groundbreaking investment of $21 billion in the United States on March 24, which the administration took credit for, although Hyundai had planned the investment long before the US election happened.

EVinfo.net urges an opposite approach. We advise giving incentives to the foreign companies to build factories in the US, use the carrot rather than the stick. We say stop the tariffs and tariff threats. We encourage promoting an economically sound, calm, stable environment where business can thrive.

We say reward our trade partners such as Canada and Mexico, work with them on a friendly and cooperative basis rather than a hostile one. These things will bring prosperity to America and success to America’s automotive industry and economy, boosting job creation and investment by foreign companies.

Regardless of all this chaos and uncertainty, EV adoption in the US and around the world will continue to grow fast. EVs are not only the most eco-friendly transportation, but the most cost-effective as well.

Electric Vehicle Marketing Consultant, Writer and Editor. Publisher EVinfo.net.

Services